Feb 5, 2020

Netflix gains after Disney results show it hasn't been replaced

, Bloomberg News

Croxon: Disney+ surges in streaming, but will have to burn cash to keep up

Walt Disney Co. reported strong subscriber numbers for its Disney+ streaming service, but it’s not the competitive risk that it may appear for Netflix Inc., analysts said on Wednesday.

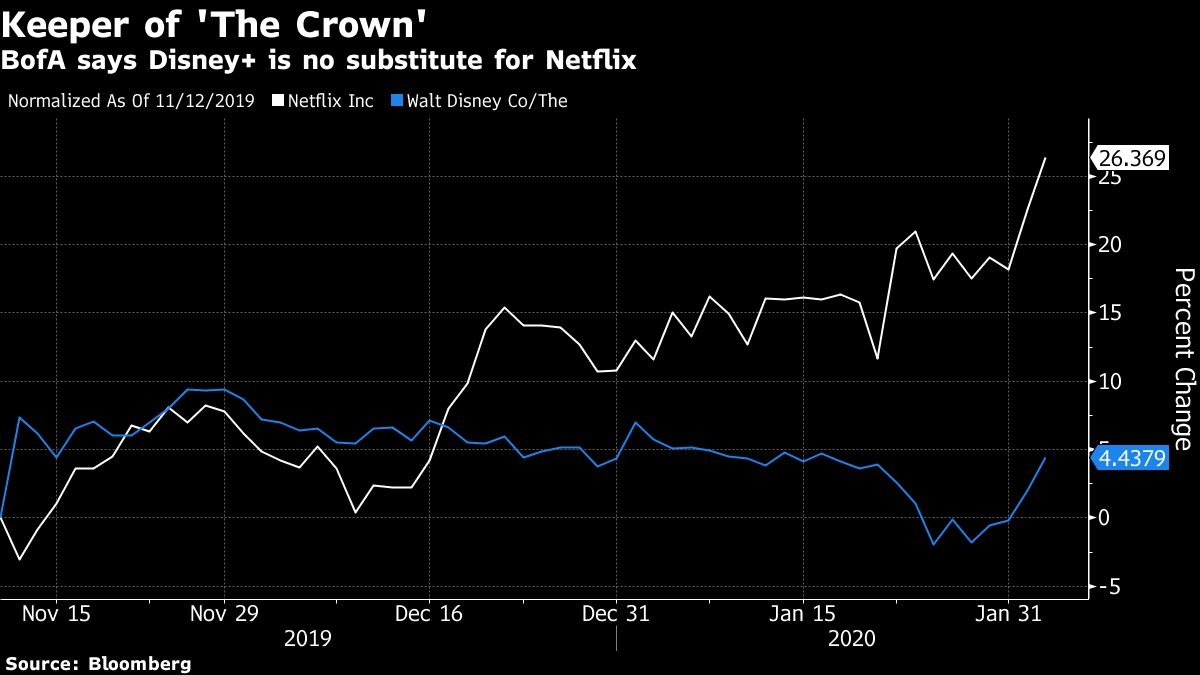

While there were both bullish and bearish takeaways for Netflix in Disney’s report, the “positive outweighs the negative,” wrote BofA analyst Nat Schindler, who reiterated his buy rating and US$426 price target on the stock. Even with this high-profile competition, “Netflix remains the OTT staple,” the firm wrote, referring to over-the-top streaming services.

Shares of Netflix rose one per cent in pre-market trading, while Disney was up 0.3 per cent. Since Disney+ debuted in November, Netflix shares have easily outperformed Disney.

“It is clear Disney+ engagement trails that of Netflix and this reinforces our view that Disney+ is not a substitute,” BofA wrote, noting that viewing hours per Disney+ subscriber “widely trail those of Netflix.” This engagement disparity could continue as Disney’s most high-profile streaming releases for this year — including Marvel programs and the second season of “The Mandalorian” — are “clustered” in the fall and fourth quarter of 2020. “This limits Netflix’s competition from a content perspective,” BofA wrote.

BofA added that Disney’s international rollout of Hulu wasn’t likely to start until 2021. This is “an incremental positive” for Netflix’s international expansion, given “Disney’s limited ability to offer a bundle overseas for now.”

That view was echoed by Raymond James, which reiterated its strong buy rating on Netflix shares. While Disney+ is off to an “exemplary start” and there will be more debate about the risk Netflix faces from competition, “we prefer to take a page from ‘Frozen’ and ‘Let it go,’” analyst Justin Patterson wrote to clients. He added that Disney’s results reinforce the idea that streaming services can co-exist, and that traditional cable is where things are struggling.

In a sign of how streaming has been dominating over “linear” television, Bloomberg Intelligence recently estimated that the fourth quarter may end with 1.7 million pay-TV “defections.” Cord-cutting losses “have jumped over 50 per cent from prior quarter averages,” in part due to the rise of new streaming services, analyst Geetha Ranganathan wrote in late January.