Apr 19, 2022

Netflix loses 200,000 customers, its first decline in a decade

, Bloomberg News

I can’t remember a time when Netflix had negative subscriber growth: Dan Morgan

After a decade of meteoric growth that shook Hollywood to its core, Netflix Inc. has run into a wall.

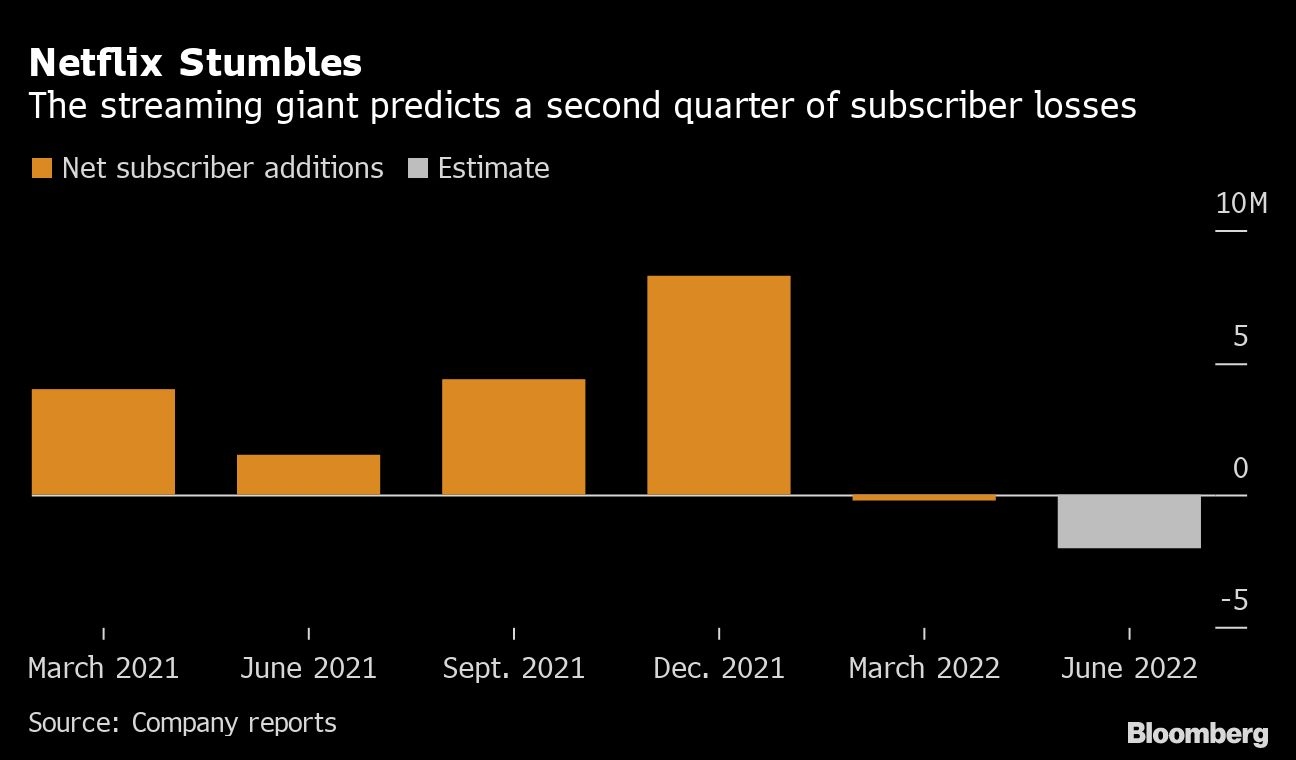

The streaming service lost 200,000 customers in the first quarter, according to a statement Tuesday, the first time it has shed subscribers since 2011. Netflix also projects it will lose another 2 million customers in the current second quarter, setting up its worst year ever as a public company.

Investors, analysts and Hollywood executives had been bracing for the company to report a sluggish start to the year, but Wall Street still expected Netflix to add 2.5 million customers. The shares, already down more than 40 per cent this year, tumbled as much as 24 per cent to US$265.11 in after-hours trading.

Netflix management pointed to four causes, including the prevalence of password sharing and growing competition. The company said there are 100 million households that use its service and don’t pay for it, on top of its 221.6 million subscribers. The company is experimenting with ways to sign up those viewers.

“Our relatively high household penetration -- when including the large number of households sharing accounts -- combined with competition, is creating revenue growth headwinds,” management wrote in a letter to shareholders.

The results will have ramifications for all of the big entertainment companies. After watching millions of customers abandon pay TV for streaming, U.S. entertainment giants have merged and restructured to compete with Netflix in streaming. Investors encouraged this strategic shift, buying shares in companies like Walt Disney Co. that demonstrated a commitment to streaming.

LATE ENTRANTS

Netflix’s troubles will cause investors to question whether the later-arriving media companies will sign up enough customers to justify all the money they are spending on fresh programming. Disney fell as much as 5.2 per cent in extended trading, while Warner Bros. Discovery Inc., the owner of HBO Max, declined as much as 2.8 per cent.

Co-Chief Executive Officers Reed Hastings and Ted Sarandos had dismissed the company’s recent slowdown in growth as a speed bump related to the pandemic, which accelerated its growth in 2020. But its subscriber acquisition has slowed for a year and a half, and the company hasn’t reverted to pre-pandemic levels.

“The big COVID boost to streaming obscured the picture until recently,” the company wrote in its letter.

Netflix lost customers in three of its four regions, including more than 600,000 in the U.S. and Canada. It blamed most of that attrition on a price increase, and said the decline was expected. Russia’s invasion of Ukraine cost the company another 700,000 customers when it had to pull its service in Russia, resulting in a loss of 300,000 customers in the Europe, Middle East and Africa.

BRIGHT SPOT

Asia was the lone bright spot. Netflix added more than 1 million customers in the region, buoyed by popular new titles such as the South Korean drama “All of Us Are Dead.”

Overall, Netflix had forecast subscribers would grow by 2.5 million in the first quarter, roughly in line with Wall Street estimates. For the current period, analysts were predicting gains of 2.43 million.

Netflix remains well ahead of most of its competitors outside the U.S., and is the largest streaming service in the world. The company believes it can execute its way out of the current predicament by luring new customers with better programs and finding more ways to charge its existing user base. Whether Wall Street believes that is up for debate.

First-quarter revenue grew 9.8 per cent to US$7.87 billion, missing analysts’ estimates. Profit, at US$3.53 a share, easily topped projections of US$2.91.

For the current quarter, Netflix predicts sales will grow 9.7 per cent to US$8.05 billion, with profit coming in a US$3 a share. Both are below Wall Street forecasts of US$8.23 billion and US$3.02 a share.