Sep 28, 2020

New Covid Curfew Another Setback for U.K’s Indebted Pub Sector

, Bloomberg News

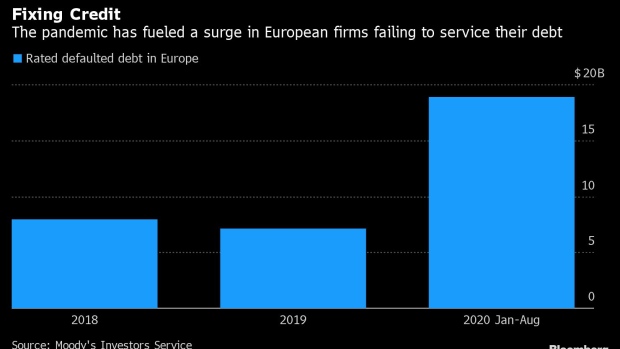

(Bloomberg) -- For the U.K.’s indebted pub companies, a new 10 p.m. curfew doesn’t just dent sales, it weighs on their debt loads too.

Bonds issued by Stonegate, the heavily leveraged owner of the Slug & Lettuce, Walkabout and Yates’ chains, have fallen to the lowest since they were sold in July. A risk gauge on the company’s debt indicates investors see a 57% likelihood it will default in five years, according to ICE Data Services.

Bonds of other large pubcos Marston’s Plc and Mitchells & Butlers Plc have also slid as investors fret.

“Pub debt is a difficult sell at the moment,” said George Curtis, a credit analyst at TwentyFour Asset Management in London. “We remain cautious on sectors which are highly cyclical and most exposed to further lockdowns.”

The U.K’s highly-competitive hospitality sector is already struggling. Restaurant chains Carluccio’s and Azzurri Group, which owns Zizzi and ASK Italian, collapsed into administration earlier this year as customers dine out less.

New economic support measures announced last week by U.K. Chancellor of the Exchequer Rishi Sunak have been largely shrugged off by pubs, restaurants and their lenders alike.

“Hospitality needs more targeted efforts to support jobs,” Kate Nicholls, Chief Executive of industry lobby group U.K. Hospitality, said in a statement after the measures. “We are still not out of the woods.”

Greater Manchester Mayor Andy Burnham warned Monday that the curfew is at risk of backfiring because it means young people are gathering to drink in the streets instead.

For Stonegate, Covid-19 couldn’t have come at a worse time.

The TDR Capital-owned company, which runs more than 700 pubs and bars across the U.K., recently took on 2.5 billion pounds ($3.2 billion) of debt to fund the takeover of rival EI Group.

Even before the curfew was announced, Stonegate told investors that it was at risk of breaching debt terms in July next year if sales were lacklustre, and a second lockdown could trigger an earlier breach, according to a Sept. 22 report from research firm CreditSights.

Sales at the company’s city-based pubs would likely fall about 16-17% due to early closing, CreditSights analysts wrote, citing Stonegate management.

“The leverage is going to keep on increasing, so I am quite negative on the company,” Nicholas Campello, a credit analyst at Spread Research in Lyon, said. The company declined to comment for this article.

In the bond market, Marston’s and Mitchells & Butlers notes have fallen in recent months. The companies already agreed waivers with creditors this year because pub closures risked them breaching debt terms.

The curfew and risk of a second lockdown may call for more leniency from lenders down the road. Curtis at TwentyFour Asset Management expects investors to continue to be “amenable” as demand slowly returns.

Marston’s declined to comment for this article. Mitchells & Butlers pointed to comments made by Chief Executive Phil Urban last week that the future outlook is “challenging and uncertain” but the company is “well placed” to meet the challenge.

For Martin Foden at Royal London Asset Management, it’s best to be invested in senior-ranking bonds in low-leveraged pub deals, as they are better placed to absorb lower revenues while still offering higher yields.

“Arguably, food-led spaces will fare better than wet-led, city-center establishments,” said Foden, the firm’s head of sterling credit research. “Uncertainty is definitely on the rise and this demands more acute selectivity when investing in pub bonds.”

©2020 Bloomberg L.P.