Jul 25, 2019

New Turkey central banker pivots with biggest rate cut on record

, Bloomberg News

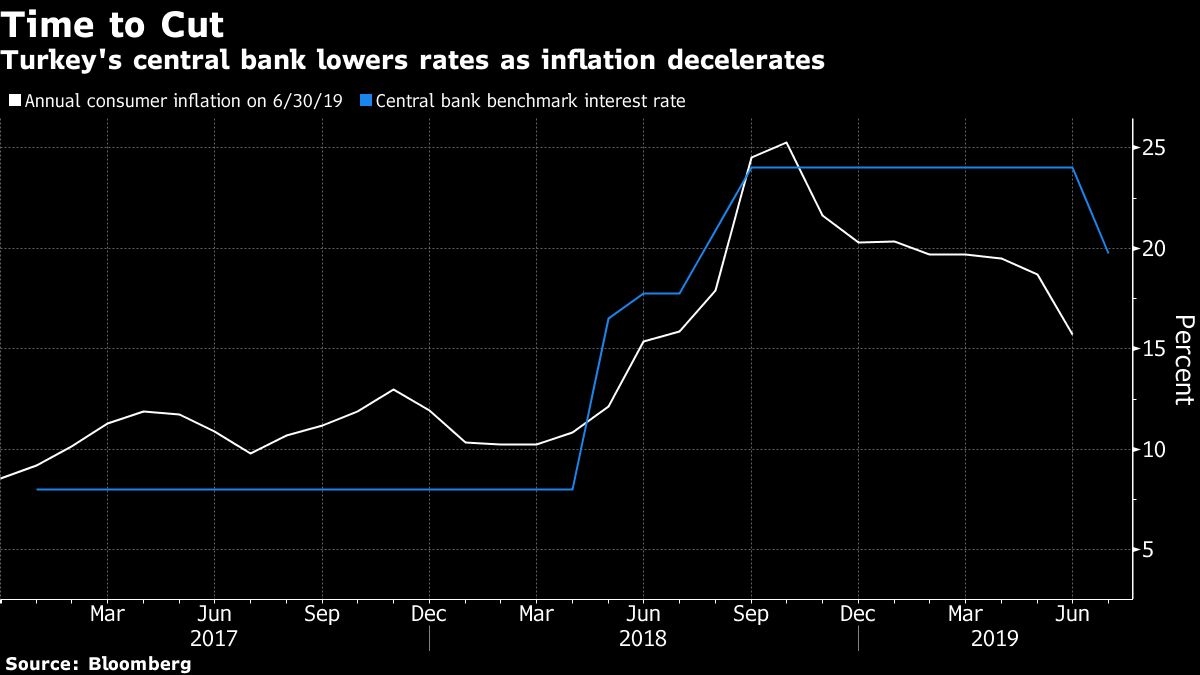

Turkey’s new central bank governor surprised markets by delivering the biggest interest-rate cut since a shift to inflation targeting in 2002, putting his credibility with investors on the line by seeking to satisfy President Recep Tayyip Erdogan’s desire for lower borrowing costs.

Less than three weeks since being installed by Erdogan, Murat Uysal oversaw a 425-basis point reduction in Turkey’s key rate as the country’s Monetary Policy Committee lowered it to 19.75 per cent on Thursday. The MPC cited “weaker global economic activity and heightened downside risks to inflation” and pledged to use all instruments to safeguard price stability.

It was the first cut since 2016 and came after economists split over how deep the central bank would go, with the median of 34 forecasts at 21.5 per cent. The lira plunged as much as 1.1 per cent against the dollar after the decision before erasing losses. It traded 0.2 per cent stronger as of 2:18 p.m. in Istanbul.

“The extent of monetary tightness will be determined by considering the indicators of the underlying inflation trend to ensure the continuation of the disinflation process,” the central bank said in a statement.

The sharp pivot toward monetary easing runs the risk of spooking inflation-wary investors in pursuit of Erdogan’s unorthodox theory that high interest rates cause rather than curb price growth. He fired Murat Cetinkaya as governor for failing to act, leaving Uysal with the challenge of how to navigate the conflicting demands of the presidency and markets.

Uysal had plenty of reasons to start an easing cycle this month. The economy continues a slow slog after recession and lending is on the decline again. A dovish turn in monetary policy globally and a downswing in price growth have left Turkey with the world’s highest real rate before the decision. Powerful base effects will likely continue to choke off inflation, which is already down almost 5 percentage points so far this year.

‘Room for Maneuver’

In an interview last week, Uysal saw “room for maneuver in monetary policy” but vowed to preserve “a reasonable rate of real return” for investors.

The lira’s fortunes have also reversed, especially after President Donald Trump indicated the U.S. may reassess a threat to sanction Turkey over its purchase of a Russian defense system. The currency is the best performer in emerging markets since the start of May.

As a drumbeat of political pressure grows on central banks from the U.S. to India, Erdogan one-upped his counterparts thanks to the powers granted to his office after last year’s general election, which transformed the political system into an executive presidency.

A wallop of monetary easing could easily unsettle the calm, however, especially if Turkey delivers cuts in the name of Erdogan’s unorthodox views.

Erdogan promised to take more direct control over rate decisions in an interview last year and warned following a massive rate increase in September that “there is a limit” to his patience. The tipping point came when Cetinkaya extended a policy pause to nine months in June, prompting Erdogan to call the 24 per cent benchmark “unacceptable.”

Erdogan’s power grab was years in the making. In his view, producers have to pass on their higher borrowing costs to customers, so they raise prices.

“The game plan is to cut rates as much as they can, or rather as much as the market will let them get away with,” Timothy Ash, a strategist at BlueBay Asset Management in London, said in an email before the decision. “Uysal was hired as the assumption is or was he will follow the presidential script, which is cutting rates.”

--With assistance from Harumi Ichikura.