Mar 17, 2023

New World Development Leads Hong Kong’s Gains in Board Diversity

, Bloomberg News

(Bloomberg) -- Hong Kong property developer New World Development Co. added three women to its board of directors in the fourth quarter, doubling the number of women at its highest level of governance and notching the biggest gain for gender diversity in among the city’s blue chips.

With 17 members, including seven from the Cheng family, which controls New World and jewelry conglomerate Chow Tai Fook, New World’s board is among the biggest among Hong Kong’s listed companies. And with 35% of seats held by women, the firm’s gender balance is better than twice the average for the city’s listed company boardrooms.

“Diversity and inclusion isn’t just about gender, but getting the right composition of experience and strength in the boardroom,” said Jenny Chiu, an 18-year veteran of the company and now New World’s senior director for human resources, in an interview on March 8. “We’re not just adding female board members for the sake of it.”

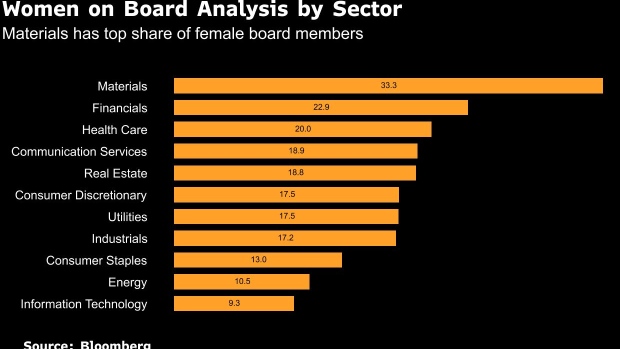

At companies in the Hang Seng Index, almost 20% of directors are women, ahead of the 15% in Nikkei 225 companies but below the major indexes in Australia, the US or Europe, where the proportion is closer to one-third.

But Hong Kong is pushing local firms to improve on measures of gender diversity. A rule that took effect in July requires firms to have at least one female director — or if a board were all women, at least one man would have to be added. The change is expected to create more than 1,300 new board seats for women.

New Hong Kong Rules Will Create 1,300 Board Seats for Women

As an HR executive, Chiu said she was able to offer a perspective on the workforce and productivity. Last summer, as Hong Kong reeled from its worst-yet Covid wave, she pushed New World to adopt a 4.5-day working week to encourage work-life balance and boost morale, a trial program that the firm may repeat this coming summer, she said.

Chiu and the other relatively new female board members are among the 10 who aren’t related to Henry Cheng, the group’s patriarch. Putting an HR executive on the board in a family-owned enterprise is a signal that governance works best when it taps talent from different fields and beyond the controlling house, Chiu said.

Women held six more seats on the boards of companies in the Hang Seng Index in the fourth quarter when compared with the previous three-month period, the biggest increase in two quarters, according to data compiled by Bloomberg. The average number of female directors rose to 2 from 1.9, out of an average board size of 11.1.

- The percentage of female directorships increased to 17.9% from 17.3%

- That is above the 14.7% of the Nikkei 225 in Asia and below the 36% of women on boards of the S&P/ASX 200 in Australia, 32.3% of the S&P 500 in the U.S. and 39% of the Stoxx 600 in Europe

- Six Hang Seng companies increased the number of women on their boards; the top companies by market capitalization were Hang Seng Bank Ltd., Li Ning Co. and Chow Tai Fook Jewellery Group Ltd.

- Two companies reduced the number of female directors: China Life Insurance Co. and Longfor Group Holdings Ltd.

- Hang Seng Bank Ltd. has the highest percentage of women on its board

- The real estate sector led the net gain in female board members, with three women added to the board at New World Development Co.

- New World Development surpassed 30% female board membership for the first time since at least January 2019. The number of Hang Seng companies above this key threshold rose to nine in January from 11 the previous quarter

- Nine companies, including Meituan, BYD Co. and Baidu Inc., do not have any female board members

- The Bloomberg Gender-Equality Index returned 16% in the fourth quarter, outperforming the MSCI World Index, which returned 9.9%

Hang Seng companies with the highest and lowest percentage of female board members:

The Bloomberg Gender-Equality Index is a modified capitalization-weighted index that tracks the financial performance of those companies committed to supporting gender equality through policy development, representation and transparency.

--With assistance from Shawna Kwan.

©2023 Bloomberg L.P.