Jun 17, 2019

New York State Weighs Law to Curtail Predatory Lending Abuses

, Bloomberg News

(Bloomberg) -- Last year, an array of New York officials, from county clerks to Governor Andrew Cuomo, promised to stop a group of predatory lenders that have been using the state court system to bludgeon small businesses nationwide.

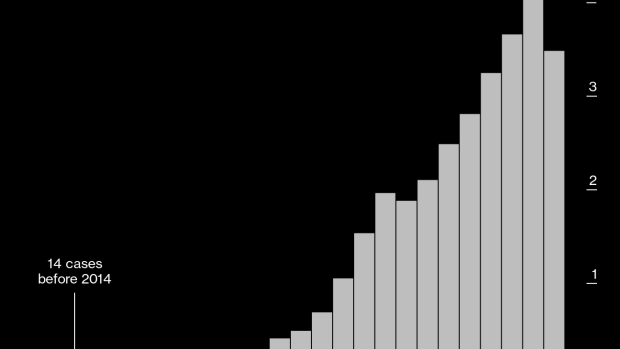

So far, little has changed. Lenders offering so-called merchant cash advances obtained more than 5,500 New York court judgments against borrowers in the first five months of this year, about the same monthly pace as in 2018, according to data compiled by Bloomberg News.

This week, the state legislature will decide whether to finally crack down. It’s considering a bill that would curtail the lenders’ use of confessions of judgment, legal instruments that short-circuit the normal litigation process and are prone to abuse. The bill, which would prohibit their use against out-of-state debtors, has cleared two committees in the Assembly and could come up for a vote before the legislative session ends on June 19.

“I’m hopeful that Albany will act on this issue,” Senator Brad Hoylman said in a June 13 statement. The Democrat runs the Senate Judiciary Committee and introduced a companion bill in that chamber.

400% Interest

Cash-advance lenders offer small businesses such as landscapers and coffee shops unregulated, short-term loans that can cost the equivalent of 400% or more in annualized interest. Some firms require borrowers to sign a confession of judgment just to get the money.

By signing, borrowers waive their legal rights and agree in advance to lose any dispute that might arise. If the lender declares a default, a county clerk in New York simply rubber-stamps the judgment without notice or a hearing. Often, borrowers find out about a judgment only after the lender begins to seize their bank accounts or other assets.

Bloomberg News reported on abuses of the system in a series of articles last year. The articles described lenders using confessions of judgment that were forged or materially altered, falsely accusing borrowers of missing payments and overstating the balance due. Lenders would sometimes make more money by declaring a default and seizing a borrower’s cash than they could by getting paid back on schedule.

After the articles were published, the New York attorney general’s office opened a probe, and three county clerks who together had handled almost half of the industry’s caseload stopped processing most judgments by confession.

Ontario, Kings

The boycott didn’t slow things down much. Cash-advance lawyers just sent more cases to counties that still accept confessions of judgment, including Ontario County, on the northern end of the Finger Lakes district, and Kings County, otherwise known as Brooklyn.

Ontario has handed out at least 1,824 judgments this year, or about one of every three filed in the state. County Clerk Matthew Hoose didn’t respond to a message seeking comment.

“The filing of COJs is just as rampant as ever,” said Aaron Todrin, who advises small businesses on debt as president of Second Wind Consultants Inc. in Northampton, Massachusetts. “These guys are ruthless and relentless.”

The cash-advance industry has won more than 32,000 New York judgments by confession since 2012, mostly in the past two years, according to data compiled by Bloomberg. And allegations of abuse continue to pile up.

“Get your resume ready, because I am taking the company down,” the chief executive officer of one lending company told an employee at an Illinois business in February before doing just that, according to a court complaint. The same CEO emailed employees at a New Jersey business in May: “How you liking the judgment boys?” Both of those businesses claim in court papers that judgments were filed without a valid reason.

In March, former U.S. Army Captain Steve McKeon borrowed $352,000 for his California construction company. Two days later, he claims in a lawsuit, the lender falsely accused him of missing payments and swiftly won a New York state court judgment against him for twice that amount, freezing his bank accounts and causing “irreparable” harm to his business.

Court records don’t show if the lender ever responded to McKeon’s lawsuit, and a lawyer for the lender didn’t respond to messages seeking comment. McKeon declined to comment. The judgment against him was vacated in April.

But borrowers rarely put up a fight. They often can’t afford to hire a lawyer because their assets are frozen, and New York judges typically side with the lenders anyway.

‘Bad Underwriting’

The bill that cleared the Assembly committees was introduced at the request of the state’s chief administrative judge, Lawrence Marks. It would preserve the state’s unusually permissive laws governing confessions of judgment against New York residents but prohibit their use against individuals who don’t live in the state, or businesses that don’t have locations there.

The bill cleared the committees on mostly party-line votes, with all of the panels’ Republicans in opposition.

“We don’t see anything wrong” with current law, said Michael Montesano, a Republican assemblyman who sits on both committees. “This is an agreed-upon situation between debtors and the creditors. It’s disclosed in their contracts. It’s part of the contract negotiation.”

The Commercial Finance Coalition, a trade group whose members include some of the biggest users of confessions of judgment, has been lobbying for a different approach. The group recommends prohibiting confessions entirely on the smallest deals, but allowing them to continue to be filed against out-of-state debtors on transactions of more than $100,000, according to Dan Gans, the group’s executive director.

Another industry group, the Small Business Finance Association, supports the legislation as drafted but would prefer a total ban on confessions, said Stephen Denis, the organization’s executive director. “Any company that is counting on COJs as a collection practice, they are just practicing bad underwriting,” he said. “They should be leaving the industry anyway.”

--With assistance from David Ingold and Demetrios Pogkas.

To contact the reporters on this story: Zachary R. Mider in New York at zmider1@bloomberg.net;Zeke Faux in New York at zfaux@bloomberg.net

To contact the editors responsible for this story: Robert Friedman at rfriedman5@bloomberg.net, David S. Joachim

©2019 Bloomberg L.P.