May 29, 2023

New Zealand House Prices to Rise Earlier Than Expected, ANZ Says

, Bloomberg News

(Bloomberg) -- New Zealand’s house prices will start rising in the second half of 2023, several quarters earlier than expected, in response to looser monetary conditions and surging immigration, according to ANZ Bank New Zealand.

Prices will likely gain 1.6% in both the third and fourth quarters, the lender said in a research note Tuesday in Wellington. The nation’s housing market has declined about 16% over the past year and a half.

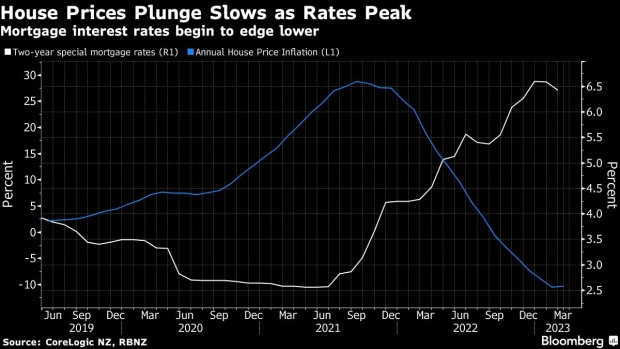

Property prices began tumbling in the final months of 2021 and most economists expected them to drop by about 25% as rising interest rates forced buyers to the sidelines. But an unexpected surge in net immigration and the Reserve Bank’s signal that the Official Cash Rate may now be at a peak has prompted a rethink.

“Pressure already appears to be easing on some fixed mortgage rates,” ANZ Chief Economist Sharon Zollner said in the note. “It looks like housing tailwinds are now blowing stronger than headwinds. Accordingly, we think the housing market has found a floor.”

ANZ said the RBNZ’s decision to ease restrictions on low deposit lending from June will also provide a boost to demand. At the same time, slowing construction means a shortage of housing could re-appear, it said.

Still, the house price recovery won’t sustain its initial pace, ANZ said. It expects the RBNZ will need to raise rates once more this year while immigration inflows will slow from their current pace.

©2023 Bloomberg L.P.