Aug 16, 2022

New Zealand Raises Key Rate Another Half-Point; Currency Gains

, Bloomberg News

(Bloomberg) -- Sign up for the New Economy Daily newsletter, follow us @economics and subscribe to our podcast.

New Zealand raised its key interest rate by another half-percentage point and sees it climbing to at least 4%, cementing the central bank’s place at the forefront of global tightening.

The Monetary Policy Committee lifted the Official Cash Rate to 3% as expected on Wednesday, while increasing and bringing forward its forecast rate peak. That commitment to further tightening sent the currency and policy-sensitive two-year government bond yield higher.

“RBNZ communication today was strikingly hawkish,” said Andrew Ticehurst at Nomura Holdings Inc. “Many market participants appear to have been on the look-out for a potential dovish pivot today” and had to adjust.

New Zealand policy makers are trying to strike the same balance as their Federal Reserve counterparts: rein in the fastest inflation in more than a generation without cratering the economy. While unemployment has edged up and house prices are falling, consumption is holding up and supporting growth.

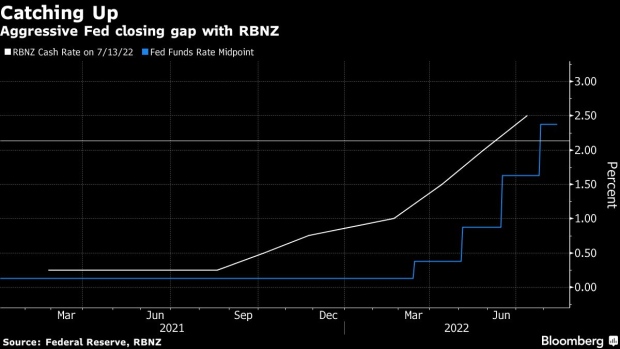

New Zealand’s 2.75 percentage points of hikes in the past 10 months are the most aggressive tightening cycle it has delivered since pioneering inflation targeting more than 30 years ago. It currently exceeds the Federal Reserve and Bank of Canada’s 2.25 points apiece.

“Our view is that sitting around that 4% official cash rate level buys the monetary policy committee right now significant comfort that we would have done enough to see inflation back to our remit,” Governor Adrian Orr told reporters after the decision, referring to the RBNZ’s 1-3% target

The response of New Zealand’s economy to the rapid-fire rate increases will be closely watched by global investors.

The risk is that Orr and his team press the brakes too hard, squeezing the housing market and consumer spending to such an extent that it stalls growth. Goldman Sachs Group Inc. sees a 30-35% chance of a recession over the next 12 months

The RBNZ’s updated forecasts Wednesday showed the OCR peaking at 4.1% in the second quarter of 2023 versus a May estimate of 3.95% in the third quarter of that year. The new track shows the OCR gradually declining from 2024.

“The committee agreed it remains appropriate to continue to tighten monetary conditions at pace to maintain price stability and contribute to maximum sustainable employment,” the RBNZ said in a statement. “Core consumer price inflation remains too high and labor resources remain scarce.”

Investors and economists expect most central banks to keep raising rates rapidly. Bets on the next Fed hike oscillate between 50 and 75 basis points, while Australia is tipped to raise its benchmark by a half-point next month.

What Bloomberg Economics Says...

“The RBNZ is now clearly prioritizing near-term inflation risks over concerns about growth, the labor market, house prices or financial stability.”

--James McIntyre, economist

For the full note click here

Still, the Bank of Korea has signaled it’s likely to return to quarter-point increments as concerns mount over its highly-indebted households.

New Zealand inflation is running at 7.3%, the fastest pace in 32 years. The central bank predicted it will slow to 5.8% by the end of 2022 -- higher than the 5.5% seen in May. Inflation will ease to 3.8% by the end of 2023 and is not seen returning to the midpoint of the target until mid-2024.

Wages meanwhile are now rising at the fastest pace since 2008 and set to further accelerate as firms struggle to secure labor.

The bank projects annual average economic growth of 2.8% in the year through March 2023, slowing to 0.8% in the 12 months through March 2024. Previously, it saw 2023-24 growth of 1.3%.

“Downside growth risks remain very real,” said Sharon Zollner, ANZ Bank’s chief economist for New Zealand. “We anticipate that the economy would be in recession in 2023 in the absence of a strong net exports recovery.”

Still, with domestic inflation “not yet showing any signs of easing, and the nominal economy inflating, the RBNZ can’t afford to let up with interest rate hikes,” she said.

(Updates with comment from Bloomberg Economics, new chart.)

©2022 Bloomberg L.P.