Nov 15, 2022

Newly Empowered Xi Pivots to Stabilize China at Home and Abroad

, Bloomberg News

(Bloomberg) -- After Chinese President Xi Jinping set himself up to rule for life last month, markets plunged as investors braced for years of more ideological rule. Since then, however, he’s displayed a newfound pragmatism.

Over the past week, Xi has made his biggest moves in years to stabilize the world’s second-biggest economy, which is growing near the slowest pace in four decades. He delivered a plan to rescue the battered property sector, provided a potential exit ramp from his costly Covid Zero policy, and improved ties with the US during a meeting with Joe Biden at the Group of 20 summit, where the Chinese leader mingled maskless.

Together the moves amount to a major shift in tone by Xi, who has shown a willingness over the past few years to hobble some of China’s biggest companies and sacrifice economic growth in top-down campaigns to rein in debt, reduce income inequality and prevent Covid-19 deaths. While those policies remain in force, the fine-tuning is a welcome respite for those looking for any sign that Xi will stop the economy from spiraling.

“There is no doubt at all that zero Covid, the real estate funk and bad external relations are all huge drags on China’s economy and destabilizing,” said George Magnus, a research associate at Oxford University’s China Center. “Xi is not about to change domestic economic strategies except to try and lower the risk of instability.”

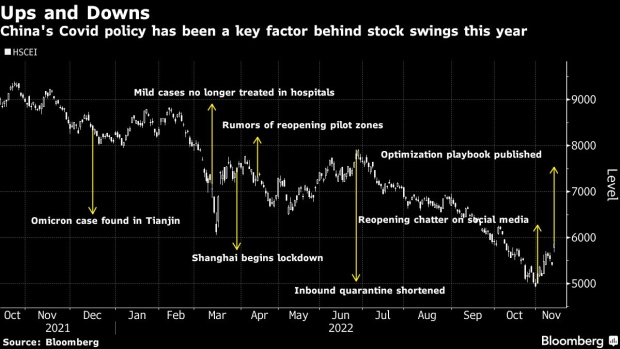

That’s enough for investors searching for reasons to scoop up Chinese stocks, which plummeted after Xi surrounded himself with allies last month while signaling a shift to prioritize security over the economy. The Hang Seng China Enterprises Index has rallied 26% this month, swinging from the world’s worst-performing stock gauge to the best.

“China appears to be rapidly addressing all the major issues on investors’ minds,” said Vey-Sern Ling, managing director at Union Bancaire Prive. “These also mitigate the broader concern that China may become more ideological, less pragmatic and increasingly isolated.”

Besides spooking investors, Xi’s policies had squeezed China’s middle class and sparked rare flashes of social unrest in a nation where any dissent could lead to lengthy jail sentences. Hundreds of thousands of people boycotted mortgage payments on unfinished properties, while a series of lockdowns across the country led to physical clashes between residents and health officials.

Read more: Covid Lockdowns Spark Violent Protests in China’s Guangzhou City

The first sign of a pivot emerged last week, when China eased the rules surrounding Xi’s signature Covid Zero policy that has kept it cut off from the world since January 2020. In a 20-point playbook for officials, Beijing reduced the amount of time travelers must spend in quarantine, pulled back on testing and ended flight bans that made travel too onerous for many citizens to even attempt.

Policymakers followed up with sweeping directives to rescue the ailing property sector, including a 16-point plan to banks that aimed to free up cash for developers and loosen down-payment rules for homebuyers. Real estate comprises around 70% of total household wealth, making it an essential sector to maintaining social stability.

The property move is a “major reversal,” according to Andrew Collier, managing director of Orient Capital Research.

Then came Xi’s meeting with Biden, the first face-to-face discussion between leaders of the US and China since 2019. During that time relations went from bad to worse, with military tensions rising over Taiwan and the US moving to cut China off from chips that are essential to driving growth in areas like artificial intelligence.

The outcome exceeded expectations, with both Xi and Biden agreeing to resume cooperation in areas such as climate, trade and food security. They also agreed on red lines for Russia’s actions in Ukraine and reinforced the need for good relations, with the US president saying “there need not be a new Cold War.”

The meeting “portends a new starting point,” Chinese Foreign Minister Wang Yi told reporters afterward.

Still, it remains to be seen how far Xi can go on any of the three issues.

On Covid Zero, a lackluster elderly vaccination rate means more than a million people could perish if China starts living with the virus. Even with some easing in the property sector, local governments remain overly reliant on real-estate development. And the status of Taiwan remains an intractable issue, with little prospect of a peaceful resolution anytime soon.

“The reason Beijing is moving on this now is to arrest a further fall in market confidence, which may trigger a property-market crisis that will spill into the wider economy,” said Adam Ni, publisher of the China Neican newsletter on Chinese politics. “The latest measures may help market confidence, but it doesn’t address the deeper problems of overcapacity, affordability, debt.”

It’s those structural issues that will ultimately prove a much bigger test for Xi.

“Everyone is looking for signs that, after the party congress, the government can ease the focus on politics and make headway on reviving the economy,” said Meg Rithmire, associate professor at Harvard Business School. “These measures seem indicators that may be happening, but the question is how the policymakers react when risks public health or economic — re-emerge.”

--With assistance from Lianting Tu.

©2022 Bloomberg L.P.