May 9, 2022

Nickel is back where it started before March’s two days of chaos

, Bloomberg News

Batteries with no nickel or cobalt to lower costs and supply concerns for EV producers

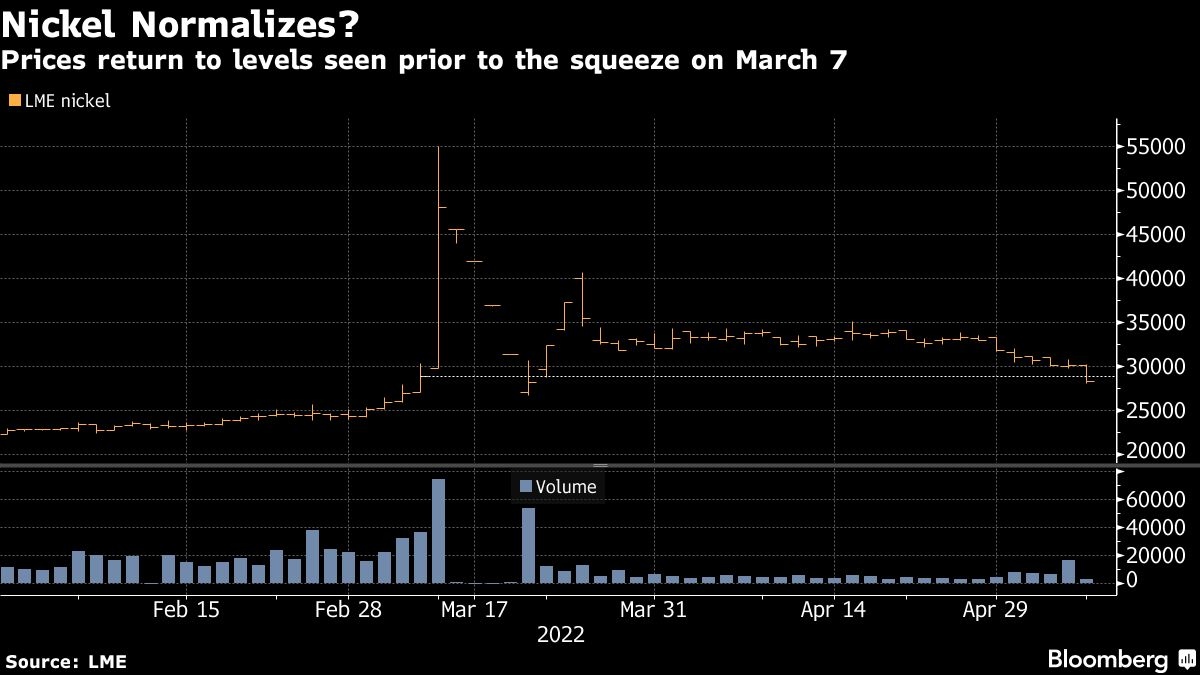

Nickel futures finally tumbled back below the level where the London Metal Exchange market closed March 4, the last trading day before prices exploded upwards in an unprecedented short squeeze.

It’s not the first time -- prices dipped under US$28,919 a ton for a couple of days in late March. But the level is a key one because Tsingshan Holding Group Co., the company at the center of the crisis, had paid its margin calls up until March 4. Further margin payments above those levels have been waived under a standstill agreement with its banks, with Tsingshan pledging to reduce its short positions once “abnormal” market conditions subside.

Nickel spiked by 250 per cent in a little over 24 hours on March 7 and 8 before the LME stepped in to suspend the market and canceled billions of dollars of transactions at the highest prices. Nickel spent weeks in limbo after it reopened, first locked for days at the new trading limits introduced by the exchange, and then drifting in extremely thin volumes.

Activity has begun to pick up as prices dropped in a wider retreat across industrial metals. Nickel volumes on the LME on Friday were the highest since March 22, which was when prices last dropped below US$29,000 and around the time that Tsingshan covered about 20 per cent of its short position, Bloomberg previously reported.

Nickel slumped as much as 6.8 per cent to US$28,025 a ton on Monday.