Mar 21, 2023

Nigeria Set to Extend Biggest-Ever Rate Hikes, Hold Off on Naira Devaluation

, Bloomberg News

(Bloomberg) -- The Central Bank of Nigeria is set to extend its steepest phase of monetary tightening to contain inflation and attract investors back into local debt, while holding off on a widely-expected currency devaluation until later in the year.

Seven of 12 economists in a Bloomberg survey predict the monetary policy committee will hike the key interest rate by 50 to 100 basis points at its first meeting since the All Progressive Congress’s Bola Tinubu was elected president in a Feb. 25 vote. The rest see no change.

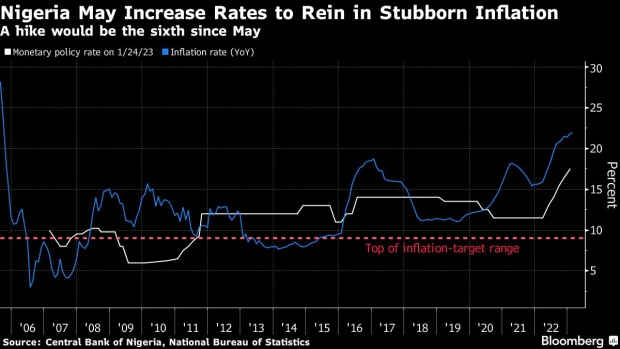

The MPC has raised the benchmark by 600 basis points since May to 17.5% to temper an inflation rate that’s been at more than double the top end of its 6% to 9% target for nine months. It’s also sought to close the gap between the two to improve market sentiment in Africa’s largest economy.

Those expecting a third back-to-back 100 basis-point hike, like REDD Intelligence’s Senior Credit Research Analyst Mark Bohlund, said risks to efforts to stabilize the currency posed by the fallout from US lender Silicon Valley Bank’s collapse and stress at Credit Suisse Group AG have added to pressure for the MPC to continue tightening aggressively.

Global banking turmoil has also led to a selloff of Nigerian dollar bonds. Yields on securities due 2029 and 2051 have risen by more than 200 basis points in the past seven trading days.

Analysts, including Abdulazeez Kuranga at Lagos-based Cordros Capital Ltd., who expect the MPC to slow its pace of rate hikes to half a percentage point, said it will do so because of concerns about overtightening and increased risks to economic growth stemming from the chaotic rollout of a plan to replace old naira notes.

The central bank’s program resulted in cash shortages that may have reduced the nation’s 198 trillion naira ($429 billion) nominal gross domestic product by 7.6% in the first quarter, Yemi Kale, KPMG Nigeria chief economist and a former statistician-general, said on Twitter last week.

Godwin Emefiele

The demonetization plan may cost Governor Godwin Emefiele his job. Politicians, especially from the ruling APC, accused him of fostering the unpopular policy to undermine its campaign ahead of last month’s election. Some state governors challenged the program in court and the Supreme Court extended a Feb. 10 deadline set by the Emefiele to phase out old notes until year-end.

President-elect Tinubu’s spokesperson Bayo Onanuga has called for Emefiele to be fired.

“Emefiele has been the worst CBN governor ever in our history,” Onanuga said. “Worst of all, his CBN brought a so-called cashless policy, that breached all established rules, that has destroyed the economy, businesses, pauperizing the poor further and inflicting unprecedented hardship on our people. Such a man should not stay a day longer as CBN governor.”

Emefiele was appointed head of the central bank in June 2014, a year before President Muhammadu Buhari came to power, and was given a second five-year term in May 2019. During his unorthodox tenure, the CBN has made major interventions in the economy, including propping up the naira, lending unprecedented sums to the government and extending credit to multiple sectors.

Naira devaluation

The CBN is likely to defend the naira for a while longer. A devaluation that analysts predicted would happen after the elections to align the currency with market perceptions is now expected after Tinubu is sworn in in May.

Nigeria operates a multiple exchange rate regime that is dominated by a tightly controlled official rate and has cut off access to foreign currency for many businesses and individuals, driving them to the unauthorized black market. This has led the spread between the managed and parallel markets to widen significantly.

In the run-up to the elections, Tinubu pledged to “carefully review and better optimize” the exchange rate system, which he’s described as “somewhat arbitrary.”

Global macroeconomic realities and the nation’s weak revenue profile have made defending the currency expensive, and it will have to dig into its dwindling reserves to continue doing so, said Ikemesit Effiong, head of research at SBM Intelligence. Reserves have been on a steady decline since September 2021.

“We will be hearing the devaluation-word in the near future,” Effiong said.

--With assistance from Simbarashe Gumbo.

©2023 Bloomberg L.P.