Jan 25, 2021

Nigerian Central Bank Keeps Analysts Guessing on Rates

, Bloomberg News

(Bloomberg) -- Nigeria’s central bank has analysts guessing about its interest-rate path this year, underscoring the distortions that are stoking inflation while output is languishing in Africa’s largest economy.

All but two of the 18 economists and investors surveyed by Bloomberg forecast the central bank will keep its monetary policy rate steady at 11.5% on Tuesday. However, the outlook for the rest of the year is far less certain.

Of the 18 respondents, 11 said the central bank will raise the key rate rate this year, with forecasts for tightening ranging from 100 basis points to 350 basis points. The rest project policy makers will hold or slash borrowing costs, with one predicting a 400 basis-point reduction.

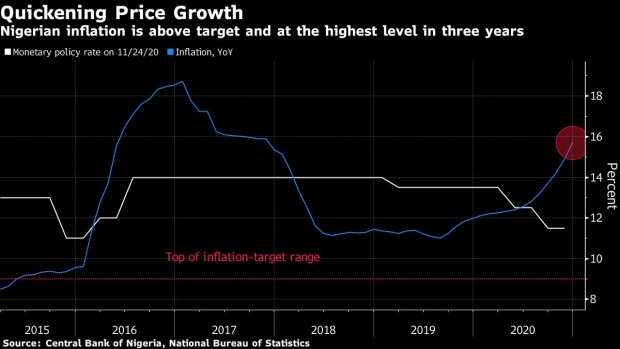

The central bank’s efforts to manage the naira and stoke economic growth in recent years rather than just focus on keeping inflation in its target band of 6% to 9% has made it more unpredictable. A sharp drop in oil prices, the country’s main export, and lockdowns at the start of the Covid-19 outbreak pushed the economy into recession.

What Bloomberg Economics Says:

“We expect policy makers to continue to overlook inflation and argue it is structural. This will allow the central bank to continue justifying the use of supply side and other policy interventions. It may also encourage the CBN to introduce new measures to narrow the disparity between the lending and deposit rates.”

-- Boingotlo Gasealahwe, Africa economist

For the full report, click here

Authorities also had to devalue the naira twice last year as a shortage of dollars pushed up import prices and increased the gap between the official and black-market exchange rates. Import restrictions announced by the central bank to help local producers have added to fuel inflation, which hit a three-year high in December.

“The disparity in views reflect the gulf between what people think the central bank should do and what they think it will actually do,” said Patrick Curran, an economist with Tellimer Ltd., who expects the central bank to raise the benchmark rate to 12.5% this year. “The bank is trying to reconcile several priorities and trying to figure out how they can keep the naira stable without harming growth more than they need to.”

High inflation coupled with a surge in local liquidity after the central bank restricted the purchase of short-term notes to bolster lending, turned the real yields of Nigerian financial assets negative. Monetary policy should work to reverse negative yields and the attract investment needed to turn the economy around, said Doyin Salami, a policy adviser to President Muhammadu Buhari.

Tightening this year would make Nigeria an outlier among major economies expected to ease or hold rates at record lows to breathe new live into their economies.

Here’s a round-up of analysts’ views:

Mohamed Abu Basha, head of macroeconomic research at Cairo-based EFG Hermes:

- “It really will depend on the extent of government’s commitment to economic reforms. If they do commit, namely to fuel-price deregulation and power-tariff hikes, then inflation will remain elevated, further prompting the CBN to keep rates on hold or even deliver some rates hikes depending on the extent of tariff hikes.”

David Cowan, Africa economist at Citigroup Inc.:

- “In recent weeks there have been signs that the current approach to policy is starting to reach its limit and there is a need to normalize monetary policy.”

- “The CBN seems to have indicated that it wants some interest rates to slowly rise again.”

- “The CBN also seems to have indicated that there can be some additional naira weakness on the NAFEX market.

- “These two moves alone do not confirm that there will be a full normalization of monetary policy into 2021. But we suspect the possibility is that it is the start of a process, even if the timing is still very uncertain.”

Guy Tossou, portfolio manager at BNP Paribas Asset Management:

- “Core inflation will continue to rise, as well as food inflation, which will trigger an avoidable rate hike going into the second part of the year. This will translate into an exchange-rate pass-through with a slow controlled pace of depreciation of the naira by year-end.”

Gbolahan Taiwo, an economist with Stanbic IBTC Bank in Lagos:

- “We see rates flat for the year but with scope to tighten at some point. Inflationary concerns and the possible need to increase rates in a bid to stimulate foreign portfolio investments could outweigh any easing bias.”

Omosalewa Arubayi, chief economist at Lagos-based Vetiva Capital Management:

- “I expect the MPC to maintain an accommodative stance keeping the MPR at 11.5%, however, a worse-than-expected growth outcome could trigger another 100 basis-point cut.”

©2021 Bloomberg L.P.