Oct 30, 2019

Nigerian Directive Could Give Ailing Stocks a Much-Needed Boost

, Bloomberg News

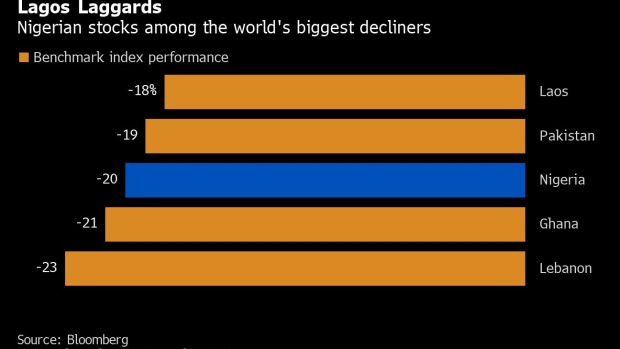

(Bloomberg) -- A ban on Nigerian pension funds buying popular high-yielding central bank bonds could end up providing a welcome boost to one of the world’s worst-performing stock markets.

As of last week, the funds are barred from the central bank’s sales of Open Market Operations bonds, short-term debt that the Abuja-based regulator uses to control liquidity. Holdings of the bonds amount to about 2.2 trillion naira ($6 billion), a quarter of the assets managed by Nigerian pension funds.

With the bonds, which yield an average of 15%, out of the picture, funds may turn instead to the local stock market, the third-worst performer globally over the past year among benchmark indexes tracked by Bloomberg.

“There is real hope this could be good for equities,” said Michael Nwakalor, an analyst with CardinalStone Partners in Lagos. “We should see a lot of corporate heavyweights gain in coming weeks as pension funds look for high-yielding investment.”

Nigerian pension funds, the largest in sub-Saharan Africa after South Africa, have cut their exposure to local shares to 5% of total assets from a high of 9% in April 2018, according to market regulator PenCom.

CardinalStone estimates that pension funds’ position in local shares may return to around 10%, mostly in companies with high dividend yields. Retirement funds could also seek higher returns in corporate debt, bank fixed deposits and other domestic government debt, according to the firm.

With only 8% of working Nigerians saving for retirement, the pension industry has vast scope to grow in a country the United Nations expects to be the world’s third most-populous by 2050. At the same time, the government of President Muhammadu Buhari needs to undertake more ambitious reforms to spur the economy and in turn make local stocks more attractive to fund managers.

“While it is possible to see some asset re-allocation towards equity markets, for pension funds to start buying equities again, the economic policy environment has to show credibility around structural reforms to unlock economic growth,” said Wale Okunrinboye, head of investment research at Sigma Pensions.

To contact the reporters on this story: Alonso Soto in Abuja at asoto54@bloomberg.net;Anthony Osae-Brown in Lagos at aosaebrown2@bloomberg.net

To contact the editors responsible for this story: Anthony Osae-Brown at aosaebrown2@bloomberg.net, John Viljoen, Jon Menon

©2019 Bloomberg L.P.