Feb 6, 2023

Nintendo Shares Face Uphill Battle With Switch Seen Past Its Peak

, Bloomberg News

(Bloomberg) -- Nintendo Ltd. has sat out the rally in tech stocks this year and may remain stuck in the doldrums until it unveils a successor to its Switch game console, which has seen sales declining over the past two years.

Shares of the fabled creator of Mario and Zelda are up less than 2% this year while Sony Group Corp. has surged 20% with help from an improved PlayStation outlook. Microsoft Corp. has gained 7% despite a post-Covid slip in Xbox sales.

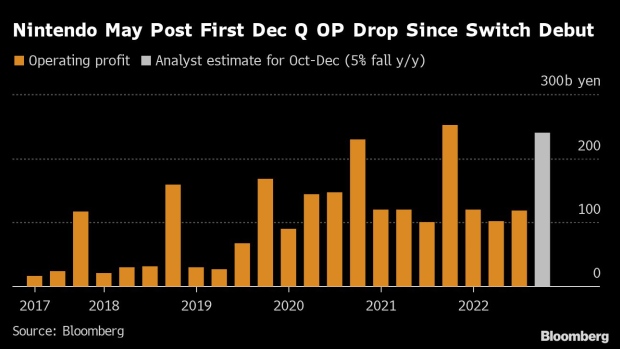

Earnings due Tuesday from Nintendo may do little to help its share price, with analysts expecting it to report a 5% drop in operating profit to 240.3 billion yen ($1.8 billion) for the quarter that ended Dec. 31. That would be its first year-on-year decline in the key holiday quarter since 2017, the year the Switch was introduced.

“I think sales of the Switch are entering a downtrend — I think that’s why its share price has not risen much,” said Hiroaki Tomori, chief fund manager at Mitsubishi UFJ Kokusai Asset Management Co. “If the sales of hardware products slow, the sales of software will inevitably also slow.”

Sales of the company’s flagship console have retreated from the peak of 28.8 million units in the financial year ended March 2021, when pandemic free time boosted demand for game machines. In light of this decline, recent news that the company plans to increase production of the the six-year-old product came as a surprise to market observers.

“The stock market does not believe Nintendo can increase Switch production,” said Kenji Fukuyama, an analyst at UBS Securities Japan Co. “This year is perceived to be a big limbo period in terms of the platform cycle — investors do not have high expectations for 2023-24 earnings.” The company will likely launch a new hardware product next year, he said.

Unlike its main rivals Sony and Microsoft, which have diverse operations in the tech and media fields, Nintendo shares are more of a pure play on video games. The Switch maker is trading at about 13 times forward earnings, several points below Sony and 10 points lower than Microsoft.

While some investors may see Nintendo as undervalued given its rich content, the company’s valuations come under pressure when its console shipments are seen peaking out, according to Fukuyama. The company’s results for the latest quarter may also show a negative impact from the yen’s rebound, he said, noting that a gain of 1 yen per dollar lowers the company’s annual operating profit by 3 billion yen.

“Thinking in terms of catalysts for Nintendo, they aren’t the stock you would choose now,” Tomori said.

Tech Chart of the Day

The 23% surge in Meta Platforms Inc.’s shares on Thursday added about $88 billion in market value to the company. Yet that’s not even close to the biggest single-day value increase of the past year. Fellow tech mega-caps Apple Inc. and Amazon.com Inc. top the tally, each gaining about $191 billion in one session.

Top Tech Stories

- Apple’s latest iPhones are selling at discounts of more than $100 in China, an unusually steep price cut just months after launch that suggests dwindling demand for even its highest-end devices.

- Dell Technologies Inc., facing plummeting demand for personal computers, will eliminate about 6,650 jobs, adding to the wave of technology companies announcing that they will let thousands of employees go.

- Microsoft Corp.’s $69 billion Activision Blizzard Inc. takeover faces a key decision in Britain as the nation’s merger watchdog marks its arrival as a global regulator with findings that could set the trajectory to the mega deal finalizing — or falling apart.

- Elon Musk says Twitter Inc. is “trending to breakeven” after he had to save it from “bankruptcy.” The billionaire said in a tweet Sunday that the last three months were “extremely tough.”

- Tesla Inc. raised the prices of its Model Y SUV in the US late Friday. The cost of the Model Y Long Range has increased by $1,500 to $54,990, while the Model Y Performance is up $1,000 to $57,990, according to the company’s website.

- Advanced artificial intelligence systems stand to threaten jobs primarily in the financial, legal and technology sectors, according to the latest MLIV Pulse survey.

- Shares of Paytm rose after India’s leading digital payments brand posted a narrower third-quarter loss with a surge in revenue.

--With assistance from Tom Contiliano and Subrat Patnaik.

(Updates at the market open.)

©2023 Bloomberg L.P.