Aug 13, 2019

No Days Off for Stock Investors Whiplashed by Nonstop Headlines

, Bloomberg News

(Bloomberg) -- When Victoria Fernandez flew to London for a vacation a few weeks ago, she had one goal: Ignore the stock market. She couldn’t.

The chief market strategist for Crossmark Global Investments woke every day to flashes from her phone -- usually red ones -- as volatility surged and nervous clients flooded her inbox. President Donald Trump pressed the trade war, China retaliated, and markets quaked. Sightseeing would have to wait.

“It’s just been nonstop activity,” Fernandez, whose Houston-based firm overseas $5 billion, said in an interview at Bloomberg’s New York headquarters. “You can’t take a day off. You can’t cut the cord. You have to stay in it because you never know what’s going to happen.”

Take Tuesday. U.S. investors arrived depressed by turmoil in Argentina and Hong Kong. Ten minutes after the open, the Trump administration changed tack on tariffs and the S&P 500 jumped as much as 2.1%, giving the index its 10th straight day with an swing of at least 1%.

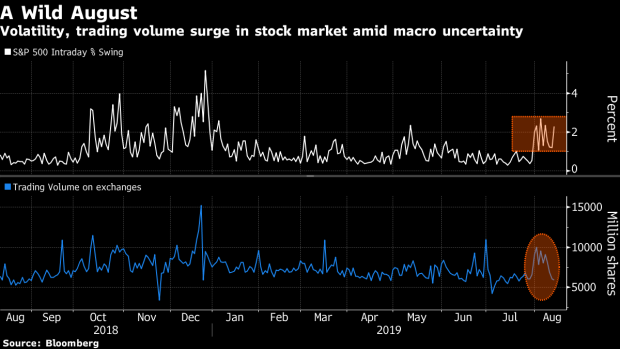

The volatility has gotten so wild this August that by one measure it’s in the 95th percentile of market swings over the last five years. And while the summer month is known for its unpredictability, that’s usually blamed on subdued volume that can breed big moves. This time, the turbulence has come with so much trading it’s on pace to be most active of the year.

“Things change on a dime, they happen quickly,” Michael O’Rourke, JonesTrading’s chief market strategist, said by phone. “You have to be aware of it. Or, you could do what some people are doing, which is you take your chips off the table, you move to the sidelines until there’s a little more clarity.”

It’s starting to remind money managers of things they’d rather forget. So far, the S&P 500 has swung an average of 1.8% a day in August. Over the last five years, only three other months have seen more erratic price action -- December 2018, February 2018, and January 2016.

Much of August’s volatility can be blamed on macro uncertainties -- economic and political events, as opposed to news on individual companies -- according to Dennis DeBusschere, head of portfolio strategy at Evercore ISI. From trade to Brexit to turmoil in Hong Kong and Argentina, political risks that investors have managed to brush aside for most of the year suddenly matter again. Currently, the total macro contribution to S&P 500 volatility is around 35%, the highest level of 2019, Evercore ISI data showed.

“Investors are taking macro cues into consideration when making asset allocation decisions,” DeBusschere said. “Ultimately, increased macro influence should allow for more consistent market, sector and factor trends, but given the chaotic nature of recent geopolitical events, we continue to recommend fading certainty,” both positive and negative, he said.

For all the turbulence, the S&P 500 sits just 3% from a record set only three weeks ago, hardly comparable to the damage done in December. Still, the size of daily moves have been unnervingly large. The equity benchmark has risen or fallen at least 1% in five of the nine August sessions, a frequency not matched at the height of fourth-quarter sell-off. The last time it happened was in February 2018, data compiled by Bloomberg showed.

The turmoil is also whipsawing individual companies, especially ones impacted by U.S.-China trade relations. Take Apple Inc., which was worth $963 billion in the stock market when August began. Three days later it was down a cool $90 billion. In the space of half an hour on Tuesday, $40 billion was restored.

Semiconductor stocks started the month with their worst five-day period in four years, only to rally more than 6% in the three days that followed. The Philadelphia Semiconductor Index added near 3% alone on Tuesday after the latest tariff developments.

Investors may want to buckle up. With market-moving headlines running hot, more spikes in volatility are probably in the pipeline, according to Chris Senyek, chief investment strategist at Wolfe Research. It could take some time for things to settle down.

“For us to become more constructive, we’d have to believe that the U.S. and China will reach a trade agreement that will increase business confidence and lead to an improving global outlook,” Senyek said. “Our sense is that this is still a long ways away.”

--With assistance from Elena Popina.

To contact the reporters on this story: Sarah Ponczek in New York at sponczek2@bloomberg.net;Lu Wang in New York at lwang8@bloomberg.net

To contact the editors responsible for this story: Jeremy Herron at jherron8@bloomberg.net, Chris Nagi

©2019 Bloomberg L.P.