Mar 29, 2023

Nomura Rates Traders Recouped Early Losses From Bank Turmoil

, Bloomberg News

(Bloomberg) -- Nomura Holdings Inc.’s rates traders bounced back from market volatility fueled by this month’s banking industry woes after the turmoil initially inflicted modest losses, according to the head of its wholesale business.

“We lost a bit of money for a few days and then we started to make money after that,” Christopher Willcox said in an interview on Friday. The European unit, home to one of Nomura’s “biggest and most concentrated rates-trading operations,” produced a “very small positive” result amid the market dislocations, he said.

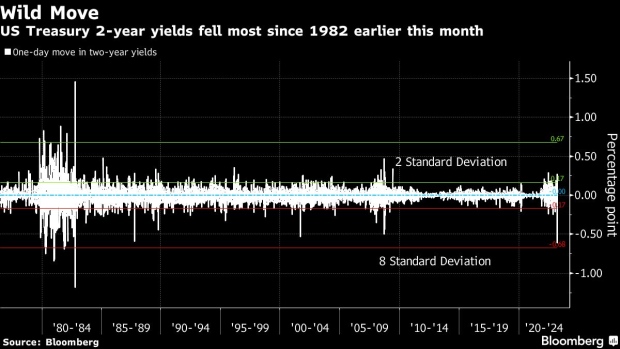

Troubles at Silicon Valley Bank and Credit Suisse Group AG triggered historic market moves during a period when Nomura pared back risk taking as per its typical year-end practice — a coincidence that may have helped the Japanese bank avoid the hits taken by some funds. Swings in the $24 trillion market for US Treasuries were more intense than those seen during the collapse of Lehman Brothers Holdings Inc. and inflicted losses on hedge funds including Rokos Capital Management and Haidar Capital Management.

“We tend not to be going into the final few weeks of the year with a massive risk on,” Willcox said, referring to the Tokyo-based bank’s financial year ending on March 31. “This happens to have coincided with a period of time when Nomura would generally be lower in our risk profile than at other times of the year. That’s just completely coincidental but I would say we were light on risk going into this volatility.”

Wait 10 Seconds, Lose $1 Million in Markets Rocked by Volatility

Japan’s biggest brokerage makes much of its revenue from trading government bonds and derivatives. So-called rates trading — the buying and selling of bonds and derivatives linked to interest rates — is a mainstay of Nomura’s business outside Japan, especially at its London-based European business.

“What generally happens for most of us is that in the early stages of a big market dislocation, the big market makers lose money,” Willcox said. “And then as they provide liquidity through that period of dislocation with the bid offers having widened out, they start to make money.”

Banks cut the risks they take at their trading businesses as they approach the end of their financial year in order to avoid losses that could blemish earnings and impact safety metrics, according to Francesc Rodriguez Tous, a finance lecturer at City University’s Bayes Business School in London.

Willcox took the helm of the wholesale arm in October, overseeing a division that spans trading, underwriting and advice on mergers. Chief Executive Officer Kentaro Okuda wants the business to generate more stable revenue from advisory and wealth management services while reducing reliance on volatile trading — a tough task as dealmaking slumps and competition to serve rich clients heats up.

The wholesale division lost money for the first time in six quarters in the three months ended Dec. 31, as trading and investment banking revenue fell. Costs swelled, partly on payments related to severances, sending a measure of expenses well above Nomura’s roughly 80% target. The setback underscored the challenge to achieve a goal of more than doubling pretax profit from the division to at least 160 billion yen ($1.2 billion) in the year ending March 2025.

Japan Focus

A Wall Street veteran, Willcox joined Nomura in 2021, one of the most tumultuous periods in its history, marked by more than $2 billion in losses from transactions with collapsed family office Archegos Capital Management.

The British national said he will make it a priority to invest in Nomura’s business in Japan, where the company generates most of its profit.

“One of the things that is on my agenda is ensuring that we invest into our Japan markets business,” said Willcox, who is Nomura’s first non-Japanese executive officer. “Clearly this is our strongest franchise.”

Nomura is keen to bolster its business associated with Japanese equities, including selling stock products to institutional clients abroad, he said. International investors are showing “a lot more interest” in Japan partly because of signs of improvement in corporate governance, he added.

Investors have been diversifying from countries including China to create a more balanced portfolio in the broader Asian region, a move that can prove “very good” for Japan as a “standout” developed market there, he said. “We should be part of that story.”

Nomura leads Japan-related stock underwriting and merger advisory rankings for the fiscal year ending March, according to data compiled by Bloomberg. It’s in third place for managing domestic corporate bond issuance, the data shows.

“When people talk about Nomura, they seem to spend an enormous amount of time talking about our international businesses because those seem very interesting,” Willcox said. “But we should never forget that the core of our firm is our home market and we have to be very successful in Japan.”

Other Comments

- Markets aren’t heading for another global financial crisis; current problems are “much more containable”

- The wholesale division’s cost-income ratio is “too high”; Nomura is “very actively looking” at expenses but no longer looking to downsize businesses

- Brexit won’t put London in a “terminal decline”; the city has “some very unique advantages” as a financial center

--With assistance from Tom Metcalf and Ranjeetha Pakiam.

(Updates with lecturer’s comments in seventh paragraph and comments from Willcox in bullet points at end)

©2023 Bloomberg L.P.