Jan 26, 2021

Nomura Sees Drop in Japan Virus Cases as Chance to Buy Stocks

, Bloomberg News

(Bloomberg) -- What appears to be a downward trend in the number of new coronavirus infections in Japan could become another reason to buy Japanese shares, according to analysts.

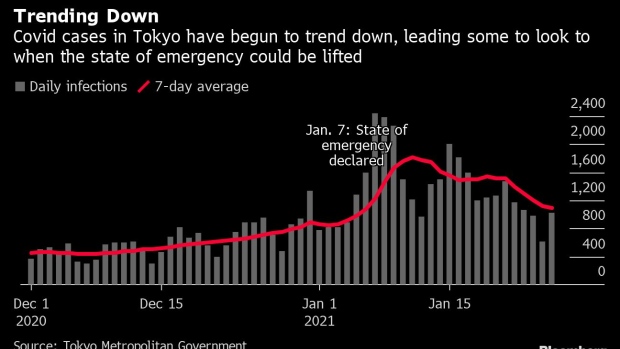

With Japan reporting fewer than 3,000 cases for the first time in a month on Monday, led by a decline in infections in the capital Tokyo, residents and investors alike are starting to look at when the state of emergency might be lifted.

“Japan’s comparative success in controlling the spread of the virus could provide further impetus for purchases of Japanese equities by global investors,” analysts at Nomura wrote in a report on Monday.

Foreigners bought a net 66.5 billion yen ($641 million) of Japanese stocks in the first two full weeks of this year in the cash and futures market. Japan’s blue-chip stock gauge Nikkei 225 has rallied 4% in 2021 so far, exceeding the 2.6% gain in the S&P 500.

During the first and second waves of infections in spring and summer last year, “once the rate of increase declined from the peak by at least 10ppt, growth in new cases remained under control for some time,” the analysts wrote in the note. “The trend may be following a similar pattern this time around.”

While new infections have fallen, Tokyo recorded 1,026 cases on Tuesday. One criteria for lifting the emergency in the capital is for daily cases to fall to around 500, though Economy Minister and Japan virus czar Yasutoshi Nishimura has said there are other factors involved and simply meeting that criteria wouldn’t mean an end to the emergency.

With the current measures largely targeting the spread of infections at bars and restaurants, the Nomura analysts noted that February tends to be the driest month of the year for social drinking events, while warmer temperatures expected that month could also reduce the spread of the disease.

©2021 Bloomberg L.P.