Aug 24, 2022

Nordstrom falls after cutting its full-year earnings forecast

, Bloomberg News

Retail sales show consumers worn down

Nordstrom Inc., which investors thought would be more insulated because of its affluent customer base, sank after trimming its full-year outlook as the retailer’s Rack business slows amid lower demand and inventory buildup.

The department-store operator lowered its forecast for full-year sales to a range of 5 per cent to 7 per cent . That one-percentage-point cut comes just three months after Nordstrom had raised its outlook. Nordstrom also trimmed its forecast for earnings per share on Tuesday.

On a call with investors, executives said they observed a clear slowdown at the end of June, particularly among lower-income customers. Now, Nordstrom will move to aggressively clear out inventory, a profit-eroding measure that’s also been necessary at other retailers, including Macy’s Inc. and Walmart Inc. After getting burned by supply-chain delays during the last holiday season, companies had ordered more goods to meet demand, only to see customers abruptly shift their spending priorities in the wake of easing pandemic restrictions and decades-high inflation.

“The lower-income customer segments saw significantly more pullback versus higher-income segments,” Chief Executive Officer Erik Nordstrom said during the call. He said customer traffic and demand began to decelerate in late June, mainly at the Rack business.

Executives told analysts they expect markdowns at the off-price business to reduce gross profit by around US$200 million in the second half of the company’s fiscal year, which is one reason for the trimmed outlook.

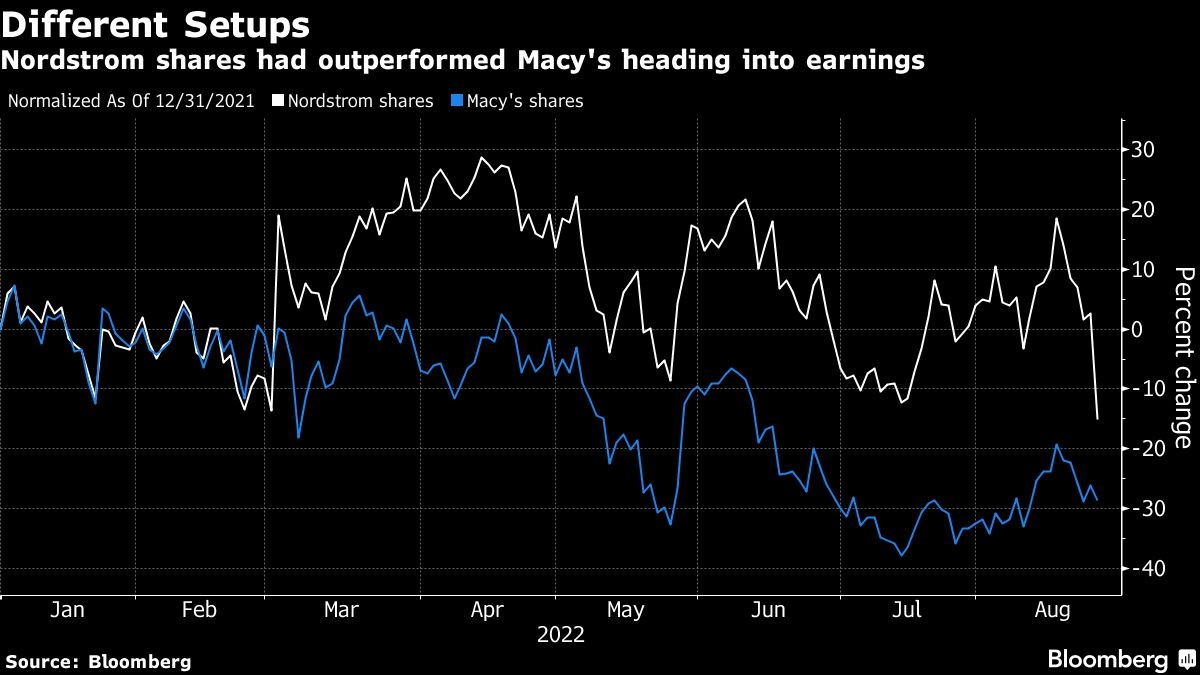

Nordstrom shares sank 17 per cent at 9:38 a.m. Wednesday in New York trading. The stock had gained 2.6 per cent in 2022 through Tuesday’s close. Other retailers had already seen a big leg down in their stocks before earnings, like Macy’s, which had fallen 29 per cent on the year before its results.

The Rack continues to cause headaches for Nordstrom. At the end of last year, the company said that poor inventory planning at the chain had dragged on revenue growth. Last quarter, sales at the off-price business were still around 2 per cent below pre-pandemic levels, despite overall growth in the market during that time. Revenue at the full-price channel, meanwhile, has surpassed pre-pandemic levels.

The results reinforce how budget-conscious shoppers are pulling back as inflation starts to pinch. Earlier on Tuesday, Macy’s cut its full-year forecast for profit and revenue on tighter consumer budgets and the likelihood of steeper markdowns to clear inventory. Its upscale Bloomingdale’s and Bluemercury businesses did well, however.

Other high-end US consumer companies, such as Capri Holdings Ltd., Ralph Lauren Corp., Estee Lauder Cos. and Tapestry Inc., have also trimmed forecasts or projected lower-than-expected growth in recent weeks. Much of that weakness, however, has been attributed to China, which is seeing reduced demand amid strict anti-Covid measures, and a strong US dollar.

Nordstrom trimmed its earnings per share guidance to US$2.45 to US$2.75, compared to its previous view of US$3.38 to US$3.68. Total revenue in the second quarter was US$4.1 billion, slightly higher than analysts’ estimates.