Mar 22, 2023

Norway Poised to Defy Turmoil With Another Hike: Decision Guide

, Bloomberg News

(Bloomberg) -- Norway’s central bank will probably raise borrowing costs to the highest since 2008, setting aside any concerns about global banking turmoil to intensify its fight against inflation.

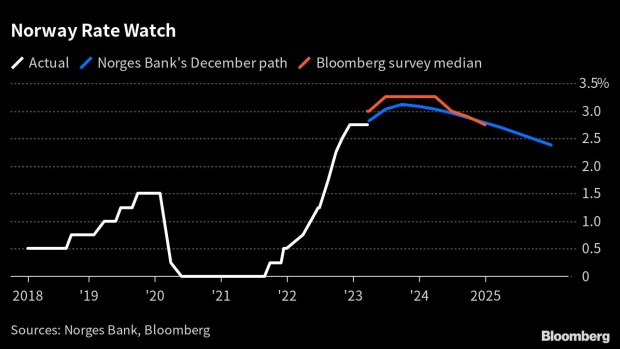

All economists surveyed by Bloomberg expect Norges Bank to raise its key interest rate on Thursday by 25 basis points to 3%.

Investors are likely to focus on the accompanying assessment of the economic outlook along with new projections for the path of monetary policy, which officials previously indicated to show rates peaking at 3.1% in the current cycle.

The Norwegian decision and those of global counterparts this week have been overshadowed by financial-market disruption in the wake of US bank failures and the takeover of Credit Suisse Group AG. That volatility has cast doubt over a Federal Reserve rate hike slated for Wednesday, the eve of the Norges Bank announcement.

Even so, inflation pressure stoked by a drop in the krone — the worst performer among the Group of 10 most-traded global currencies this year — and relatively unscathed labor and housing markets, have amped up expectations for further tightening. Some analysts won’t even rule out an even bigger-than-anticipated increase of a half point, echoing a surprise acceleration in hiking last June.

“If they’re behind the curve or if they don’t act now, they could risk weakening the Norwegian krone even further,” Sara Midtgaard, a senior economist with Svenska Handelsbanken AB, said by phone. “That could add more price pressure in the future.”

Midtgaard reckons a 50 basis-point hike is “still a possibility,” notwithstanding the financial-market turbulence of recent days.

In her first annual address last month, Governor Ida Wolden Bache indicated concern over the krone. The currency may weaken “if the foreign-exchange market is not confident that monetary policy will be tightened when inflation rises,” she said.

Measured by Norges Bank’s import-weighted exchange rate index, the krone is about 8% lower than forecast in December, also pushed down by lower oil and gas prices. It has shed 17% against the dollar over the past 12 months.

Inflation slowed more than expected in February and core price growth is in line with the central bank’s forecasts. Still, there is little sign of underlying pressures subsiding quickly.

A key survey of business sentiment by Norges Bank last week showed the energy-rich economy is developing slightly better than previously expected, with a majority of contacts planning to increase selling prices “fairly substantially” in the first half of 2023. Wage pressures have also grown ahead of Norway’s upcoming round of wage talks between unions and bosses.

Read More: Norway Wage Settlement Committee Raises 2023 Inflation Forecasts

Given the market backdrop, officials are likely to pay close attention to the Fed decision on Wednesday. In Switzerland — also an epicenter of turmoil — the Swiss National Bank’s own rate announcement is expected just half an hour before Norway’s.

Erica Dalsto, SEB AB’s chief strategist for Norway, doubts that Norges Bank would want to risk an even more aggressive response than a quarter-point move, with global turmoil still unresolved.

“I would be very surprised if they deliver a 50 basis-point hike,” Dalsto said. “Risks of tightening too much would amplify the economic downturn and increase risks related to financial stability.”

--With assistance from Joel Rinneby.

©2023 Bloomberg L.P.