Aug 15, 2019

Norway Says Global Risk Entails Greater Uncertainty on Rates

, Bloomberg News

(Bloomberg) -- Terms of Trade is a daily newsletter that untangles a world embroiled in trade wars. Sign up here.

Norway’s central bank signaled it’s growing increasingly uncertain about raising interest rates next month as global risks mount.

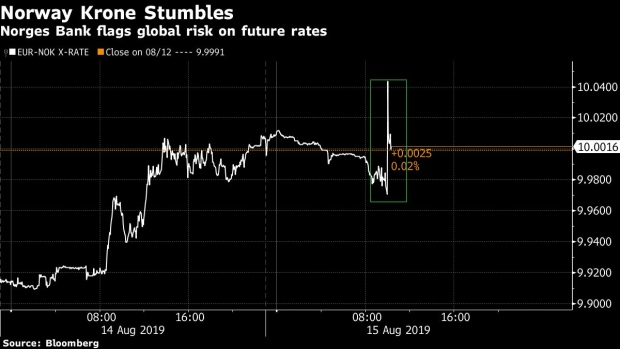

Norges Bank on Thursday left its key rate unchanged at 1.25%, as anticipated, and said its June outlook, which indicated a possible rate increase already next month, was “little changed” even as it acknowledged global risks. The krone was little changed at 10.00 per euro as of 10:19 a.m.

“Overall, new information indicates that the outlook for the policy rate for the period ahead is little changed since the June Report,” Governor Oystein Olsen said in a statement. “The global risk outlook entails greater uncertainty about policy rates going forward.”

As other nation’s find themselves stuck in negative rates and are now cutting further, Olsen and his colleagues have raised rates three times since September last year to cap inflation in western Europe’s biggest oil producer. Booming oil investments and massive fiscal spending have pushed the economy close to capacity, with wages rising at a fast clip, unemployment below 4% and inflation holding above target.

Nevertheless, the country is not immune to the global slowdown. The price of oil has plunged recently, promising to slow momentum. The Norwegian krone also slid to near a record low earlier this month, providing some support for non-oil exporters.

“The upturn in the Norwegian economy is continuing broadly as expected in June,” Norges Bank said. “Underlying inflation has been a little lower than projected. Deepening trade tensions and heightened uncertainty surrounding the U.K.’s relationship with the EU may weigh on growth abroad and in Norway. On the other hand, a weaker krone may contribute to higher inflation ahead.”

The change in tone in the statement opens up for Norges Bank delaying September’s tightening, according to economists.

“The September decision will clearly depend on whether the domestic economy is showing any weakness,” said Frank Jullum, chief economist at Danske Bank A/S. “As we expect growth to remain above trend, we still expect a rate hike in September.”

Kari Due-Andresen, chief economist in Oslo at Svenska Handelsbanken AB, said the new language indicates that “the central bank is uncertain if the policy rate will be hiked in September, but still believes December is an option.”

Thursday’s decision was a so-called interim policy meeting, meaning that the bank only released an executive summary without providing a monetary policy report or holding a press conference.

The next ordinary rate decision from Norges Bank is scheduled for Sept. 19.

(Adds krone and comments from analysts.)

To contact the reporter on this story: Sveinung Sleire in Oslo at ssleire1@bloomberg.net

To contact the editors responsible for this story: Jonas Bergman at jbergman@bloomberg.net, Stephen Treloar

©2019 Bloomberg L.P.