May 21, 2018

Norwegian Air Shuttle Hands Around the Sick Bags

, Bloomberg News

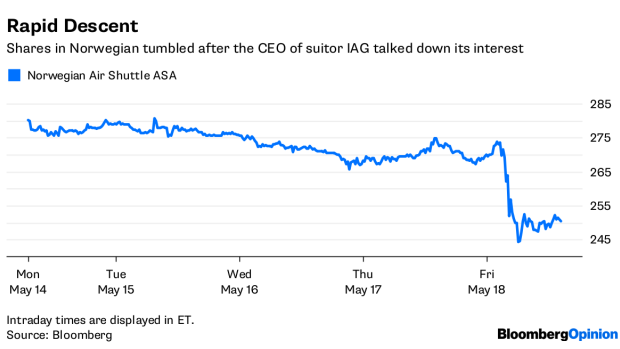

(Bloomberg Opinion) -- Willie Walsh has had shareholders in Norwegian Air Shuttle ASA reaching for the sick bags. The IAG CEO has sowed doubt about his commitment to buying the long-haul, low-cost carrier after taking a 5 percent stake last month, telling Reuters on Friday he was in no hurry for a deal and saying a hostile bid wasn't his style. He would say that, wouldn't he?

Ruling out a hostile offer removes some tension from the situation: Norwegian shares fell 7 percent on Friday. But it merely reflects reality. Norwegian's chairman Bjorn Kise and CEO Bjorn Kjos control a 26 percent block of the shares. The two are going to be central to a deal.

IAG could in theory try to buy a controlling stake without winning them around, but Walsh would being paying a premium for a management headache. What's more, that approach would risk pushing Norwegian into the arms of a rival bidder. Norwegian says IAG's stake purchase attracted interest from other airline groups. There are no details, but it's plausible.

British Airways-owning IAG hasn't indicated what the strategic logic of a deal would be. But for any buyer, Norwegian would provide an airline that would be relatively easy to slot in to existing operations. An acquisition would bring spare aircraft too – Norwegian has been buying more planes than its own fleet requirements to build a leasing business.

There's only one sure way Walsh can get hold of Norwegian: make an offer high enough to win over the target’s board and deter a gatecrasher from starting an auction. IAG is mulling a 330 Norwegian kroner per share approach, Expansion reported Monday. That would value the company at 14.6 billion kroner ($1.8 billion), a thumping 91 percent premium over the shares' volume-weighted average price in the month before IAG's interest emerged.

It's hard to see how Norwegian could reject that. The shares haven't been that high since June 2016, and never closed above 245.2 kroner in the year before IAG's interest emerged.

Still, for IAG such an offer would be a struggle to justify financially. Morgan Stanley analysts estimate the total net liabilities assumed would be about 63 billion kroner, implying an all-in cost of 77 billion kroner at the mooted price. To make returns in excess of the industry's 9 percent average cost of capital would mean finding savings worth a multiple of Norwegian's forecast 2.9 billion kroner of operating profit for 2020.

IAG typically targets a 15 percent return. This deal may have to be the exception to that rule.

Michael O'Leary, the outspoken boss of Ryanair Holdings Plc, chimed in on Monday by questioning the standalone future of Norwegian. Everyone is talking down the price. But IAG didn't buy a 5 percent stake for fun and it won't want to get into a bidding war. Walking the talk won't be easy.

To contact the author of this story: Chris Hughes at chughes89@bloomberg.net

To contact the editor responsible for this story: James Boxell at jboxell@bloomberg.net

©2018 Bloomberg L.P.