Mar 31, 2023

Nvidia and Meta Lead Nasdaq 100’s Powerhouse First-Quarter Gains

, Bloomberg News

(Bloomberg) -- Big tech stocks powered robust gains on Wall Street in the first quarter of 2023, with some of the market’s most notable names posting their biggest quarterly advances in years.

The group has benefited from a number of tailwinds so far this year. Turmoil in the banking sector has investors focused on the sector’s safe-haven characteristics, including strong balance sheets and revenue streams that are seen as durable even in the event of an economic downturn. At the same time, concerns about the fallout from banks has contributed to the yield on the 10-year Treasury dropping below 3.5%, down from a recent peak above 4%, and removing a major overhang on tech multiples.

The relative attractiveness of big tech has been underlined by the steep selloff it saw last year, which eased concerns about the group’s priciness, even as the year-to-date gain has major stocks like Apple Inc. and Microsoft Corp. above their long-term average valuations.

The Nasdaq 100 Index ended the quarter at its highest level since August, and it is up more than 20% off a December closing low, putting it above the threshold that represents a new bull market.

Here is tech’s first quarter in four charts:

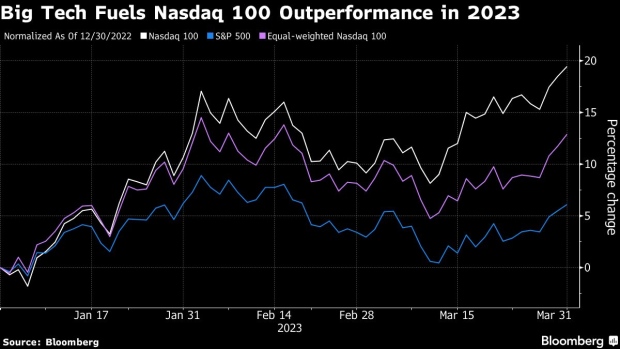

Nasdaq 100 Outperforms

The Nasdaq 100 rose 20.5% this quarter, its biggest quarterly gain since mid-2020. In a measure of how the gains were concentrated within the biggest technology and internet stocks, an equal-weighted version of the index is up less than 14%. Meanwhile, the S&P 500 Index, which is far more exposed to the financial sector, added 7% this quarter.

Nvidia Climbs on AI Frenzy

Three of the market’s biggest components were also its three biggest gainers in the first quarter. Tesla Inc. surged 68%, while investors have embraced aggressive cost cuts at Meta Platforms Inc., sending shares of the Facebook parent up 76% in its biggest quarter since 2013.

The biggest gainer on both the Nasdaq 100 and the S&P 500, however, was Nvidia Corp. The chipmaker is up 90% this year, its biggest quarterly gain since 2001. The climb reflects heightened interest in artificial intelligence, as Nvidia chips are used to power chatbots and other technology. However, the surge has underlined concerns about the stock’s valuation.

Massive Value Creation

The year-to-date gain in the Nasdaq 100 has added more than $2.4 trillion to the index’s market capitalization. That has brought the index’s value to about $15.5 trillion, compared with a peak near $20 trillion in late 2021.

The rally has made for a number of notable superlatives on the front: Apple, which dipped below a $2 trillion market cap at the start of the year, is currently valued around $2.6 trillion. Microsoft, which dipped below $1.7 trillion early in 2023, is solidly above $2 trillion again.

Meta remains far from its 2021 peaks of nearly $1.1 trillion, but its first-quarter surge has brought its market value back near $550 billion. It fell below $240 billion at its lows of last year.

An Improved Technical Picture

The year-to-date gains have been fairly broad based, with only a handful of Nasdaq 100 stocks down double digits thus far in 2023. This has made for an improved technical picture, with about two-thirds of the gauge’s components above their 200-day moving averages. In late September, fewer than 8% of components were above this closely watched level.

(Updates to market close.)

©2023 Bloomberg L.P.