May 25, 2023

Nvidia Short Sellers Lose $2.3 Billion in One Day as Stock Soars

, Bloomberg News

(Bloomberg) -- Traders betting against Nvidia Corp. suffered massive losses as the chipmaker’s stock surged to a record high after it forecasts sales that far surpassed the average analyst estimate.

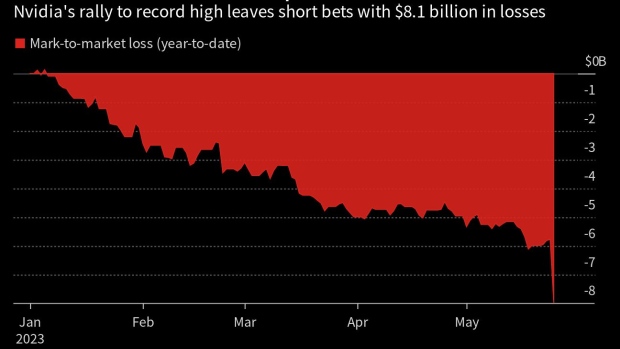

Short sellers are facing $2.3 billion in paper losses on Thursday alone amid the tech giant’s 27% intraday jump, data from S3 Partners LLC show. That’s pushed mark-to-market losses for the contrarian traders to $8.1 billion in 2023 as Nvidia’s price has more than doubled this year.

To be sure, many short sellers have dumped their positions in the chipmaker amid its record rally. In the last 30 days, the number of shares shorted decreased nearly 11%, signaling that traders are covering their positions at a loss. So far this year, total shares shorted are down roughly 23%.

Read more: Nvidia Soars to a Record as Worldwide AI Boom Fuels Chips Demand

Still, Nvidia’s notional short interest value — the amount of money short sellers have bet on the stock’s decline — is more than $9 billion. That makes Nvidia the fourth most-shorted stock in the US, behind only Apple Inc., Tesla Inc. and Microsoft Corp.

Nvidia has been one of the biggest beneficiaries from the growing craze surrounding artificial intelligence, and there could be more pain ahead for short sellers if Nvidia’s winning streak continues as many on Wall Street believe it will. The stock currently has 47 buy ratings, 10 holds and no sells with an average price target of $429, according to data compiled by Bloomberg.

Read more: ASML, Europe’s Most Valuable Tech Firm, Defines Global Chip War

“Our expectations for NVDA’s future revenues are lifting substantially,” Wedbush analyst Matt Bryson wrote in a note upgrading Nvidia to outperform from neutral. He pushed his price target to $490, implying an additional roughly 29% in upside for shares from Wednesday’s close.

©2023 Bloomberg L.P.