Dec 9, 2021

‘Obsessed With Inflation’: Trader Cites Her Roots for Right Call

, Bloomberg News

(Bloomberg) -- Among the current generation of traders in the U.S. and Europe, many have had little experience dealing with the risks of inflation. That’s not the case with Semin Soher Power.

The 44-year-old Istanbul native, who heads the Bank of Ireland Group Plc’s inflation-trading desk in Dublin, said living through Turkey’s many financial crises and bouts of hyperinflation gave her an early education on the real-world effects of surging prices.

“Growing up in Istanbul probably explains why I’m so obsessed with inflation,” Soher Power said in a phone interview. “I even remember in my childhood, my granny having her friends over. And that the topics they discussed weren’t fashion or photos, they were about the best way to save because there was double-digit inflation. They would be saying ‘OK, we will buy gold’ and everybody was sort of saving in real assets, including also real estate and foreign currencies.”

The moral of this story? Always listen to granny. Soher Power’s youthful experience hanging around her grandmother helped color her views on inflation and eventually sharpen her skills at hedging it. She and colleagues correctly warned in a 2021 outlook that the cost-push inflationary pressures that were building on the supply side would be joined by price pressures coming from the demand side as economies reopened. That proved to be true and helped lift bond-market gauges of inflation -- known as breakevens -- as they had foreseen.

With investors everywhere hyper-focused inflation now, Soher Power and her team have been getting many more unsolicited inquiries from clients than in past years, with questions about their outlook for price pressures and how best to hedge inflation exposure. Attendance at their regular webinars has picked up pace.

An unprecedented combination of easy fiscal and monetary policies to prevent the pandemic from inducing a severe global economic downturn helped lay the groundwork for higher prices. As countries began to reopen, strong demand was met by frayed supply chains, labor shortages that fanned wage increases and soaring energy costs.

Soher Power started the bank’s inflation-trading desk in 2018 within the corporate and markets area and hired two colleagues. At the time, inflation had been low for years and wasn’t an imminent threat.

“People still had the mentality back in 2018, after coming off the global financial crisis, that there is no inflation and we don’t need to worry about it,” said Soher Power, who previously worked as a portfolio manager at Amundi SA in Dublin and at DenizBank in Istanbul. “But this year, people really started to look at their inflation exposure and how they could hedge it -- even in Europe, after the European Central bank changed its inflation target from below, but close to, 2%, to a 2% symmetrical target.”

In the wake of this hot inflation wave, many central banks have turned hawkish or begun to signal a change coming. In the near term, Soher Power and colleagues believe a downside correction is likely now that the Federal Reserve’s tone also has turned more hawkish.

2022 Rates

Last week, Chairman Jerome Powell said the Fed should consider scaling back its bond buying at a faster pace -- even wrapping it up earlier than the mid-2022 end-date initially planned. That would give the Fed the option to raise rates in 2022. Traders are pricing in a move in about June.

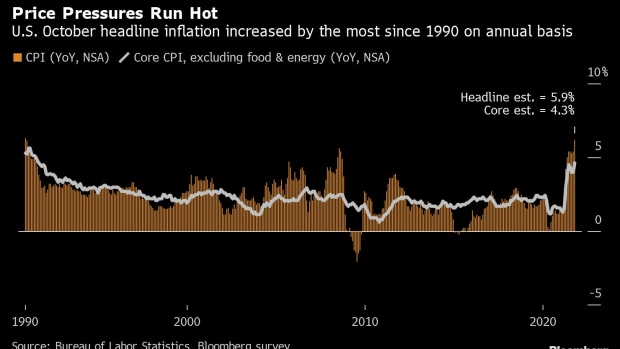

A new reading on U.S. inflation due Friday could put even more pressure on the Fed to dial back policy easing. According to Bloomberg Economics, November’s Consumer Price Index will show the fastest rate of inflation since 1982.

The Fed’s pivot, which included Powell telling Congress that it was time to retire the term transitory with regard to inflation, has sent bond-market measures of future price pressures spiraling lower. The five-year so-called breakeven rate, which gauges where traders expect consumer prices to average for the coming half-decade, hovers at about 2.9%, down from a peak of 3.25% in November.

‘Contractionary’ Policy

Powell’s comments suggest the breakevens have more room to fall, Soher Power said.

“The Fed is set now for a faster taper and front-loaded rate hikes,” she said. “And next year, U.S. fiscal policy will be contractionary. Breakevens should correct further and risk-asset prices may go lower.”

A further dip in bond-market signals doesn’t mean a reversion to the pre-pandemic era and inflation going back under the carpet for good, said Soher Power, a member of 100 Women in Finance, a group started in 2001 to empower females to advance in the industry.

“The longer-term trend will be much more balanced now on inflation, with people continuing to price in a positive inflation-risk premium,” she said. “Inflation-hedging demand will continue to be there.”

©2021 Bloomberg L.P.