Dec 12, 2019

Offshore Yuan Stages Biggest Rally Since August on Trade Deal

, Bloomberg News

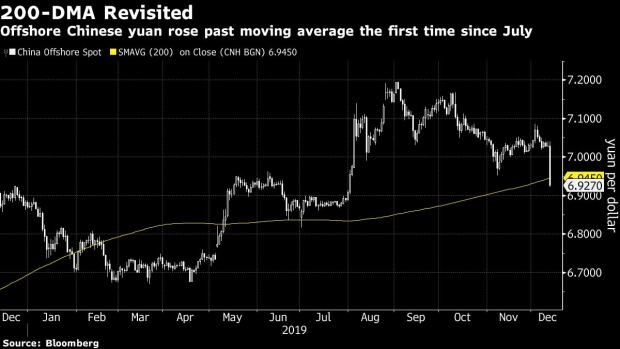

(Bloomberg) -- The offshore Chinese yuan staged its biggest rally in more than four months on Thursday as the U.S. reached a trade agreement with China, paving the way to at least a temporary end to tension that has roiled markets all year.

The yuan advanced 1.2% to 6.9457 per dollar, the highest since July 31 after trimming a gain of as much as 1.5% and revisiting its 200-day moving average for the first time since July. The Chinese currency at one point squeaked past the key 7.00 key level last breached in August -- ironically, after President Donald Trump threatened to raise tariffs on Chinese goods as talks stalled.

Today, Trump signed off on a so-called phase-one trade deal, averting the Dec. 15 introduction of a new wave of U.S. levies on about $160 billion of consumer goods from the Asian nation, Bloomberg News reported. The U.S. has added a 25% duty on about $250 billion of Chinese products and a 15% levy on another $110 billion of its imports over the course of a roughly 20-month trade war.

The onshore yuan, meantime, closed at mid-morning New York time 0.15% higher, at 7.028 per dollar, just after news had broken that an agreement was nearing completion but before Trump signed off on it. That means it will probably surge when Asian markets open on Friday.

Traders will also eye the daily yuan fixing at 9:15 a.m. Friday Beijing time from the People’s Bank of China for potential policy signals. The reference rate was set at 7.0253 per dollar on Thursday and has stayed weaker past 7 level since Nov. 12.

Strategists from Australia & New Zealand Banking Group wrote in a client note that the yuan will weaken to 7.15 per dollar by the end of 2020 even as trade tension fades. They said a slowing Chinese economy, narrower current account surplus and strong onshore dollar demand for debt repayment will weigh on the currency.

- NOTE: George Lei is an FX strategist who writes for Bloomberg. The observations he makes are his own and not intended as investment advice

To contact the reporter on this story: George Lei in New York at glei3@bloomberg.net

To contact the editors responsible for this story: Carolina Wilson at cwilson166@bloomberg.net, Alec D.B. McCabe

©2019 Bloomberg L.P.