Jan 8, 2019

Oil CEO trades US$4 million award for US$1,500

, Bloomberg News

One of the oil industry’s highest-paid executives is taking a pay cut as his company braces for possibly difficult times ahead after its stock plunged last year.

Nabors Industries Ltd. Chief Executive Officer Anthony Petrello agreed to forfeit US$4 million in restricted stock in exchange for a symbolic award worth US$1,500, the Hamilton, Bermuda-based company said in a filing on Jan 4. The CEO’s salary is also dropping 10 per cent this year to US$1.58 million.

Shares of Nabors, the world’s largest owner of onshore drilling rigs, tumbled 71 per cent last year, the third-worst performance in the 15-company Philadelphia Oil Services Index. The firm is more exposed than rivals to international markets, which have lagged behind the U.S. in recovering from the worst crude crash in a generation four years ago.

“It’s just recognizing we could be in for a rough patch, we may have to take some actions to tighten the belt, and the first belt we’re going to tighten is on the executive officers,” said Nabors spokesman Dennis Smith. “The top guy shouldn’t be immune.”

The recent announcement by Saudi Arabia to curtail output in light of lower oil prices could dampen activity for companies working there, including Nabors. The firm terminated workers in administrative and research roles late last year, Smith said, declining to elaborate on the number. There could be additional pay cuts among the CEO’s direct reports, he said.

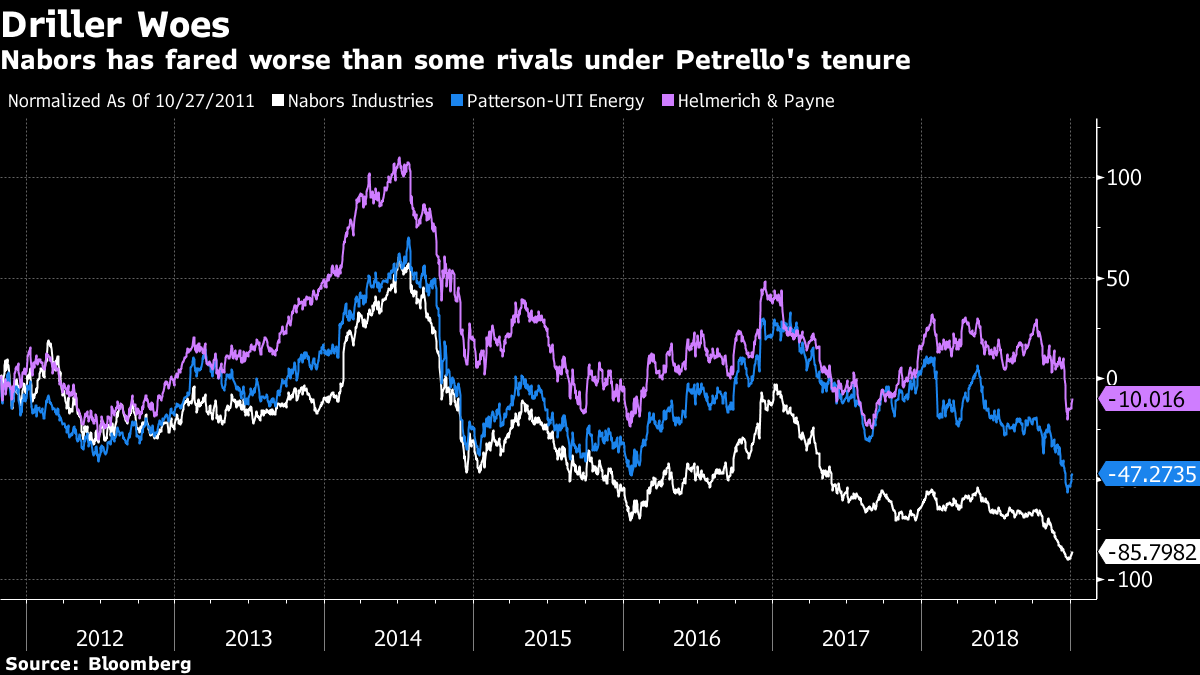

It’s unclear if the pay cuts will be enough to satisfy investors. The stock is down about 86 per cent since Petrello, 64, became CEO in October 2011, far worse than drillers Patterson-UTI Energy Inc. and Helmerich & Payne Inc. Over that period, he’s taken home US$133.6 million, counting cash compensation, perks, vested stock awards and exercised options. That’s more than double what the two rivals paid its top leaders, according to data compiled by Bloomberg.

Investors have voiced discontent with the firm’s pay practices and governance. Since 2011, Nabors has received 42 per cent support on average in its annual advisory vote on executive compensation, and shareholders have repeatedly withheld votes for directors. Support levels on pay below 80 per cent are rare at publicly traded U.S. firms.

The agreement announced Friday also included a provision that caps the number of restricted shares Petrello can receive if the firm’s stock return is negative. He previously agreed to a 10 per cent salary reduction in 2015 and 2016 as part of cost cuts.