Nov 30, 2020

Oil Declines as OPEC+ Struggles for Consensus on Output Plan

, Bloomberg News

(Bloomberg) -- Oil fell a third day as the world’s top producers sought more time to agree on delaying a planned output hike from January.

Futures in New York declined as much as 0.6%, after easing 0.4% on Monday. OPEC+ deliberations ended Monday without an agreement on next year’s oil output as tensions in the cartel simmered. A second round of talks was put off until Thursday to give ministers more time to reach a deal.

Market watchers had been expecting the producer bloc to sanction a three-month delay to a plan to add about 1.9 million barrels a day of output from the start of next year, but a postponement has run into resistance from nations including the United Arab Emirates and Kazakhstan. Saudi Arabia’s Energy Minister Prince Abdulaziz Bin Salman signaled his dissatisfaction with the situation on Monday by telling others he may resign as co-chair of a committee that oversees the OPEC+ deal.

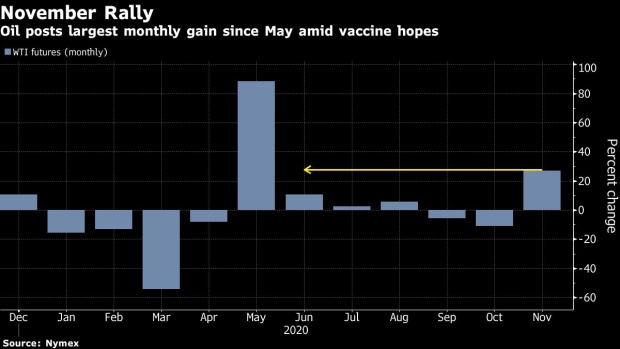

The OPEC impasse risks stalling the rally in oil prices, after progress on a coronavirus vaccine helped drive a 27% surge in U.S. crude futures in November. Also at stake is the longer-term credibility of the cartel whose actions have underpinned the market since the spectacular oil crash earlier this year.

Read: The Oil Market’s ‘Other’ Traders Are Short Like Never Before

Meanwhile, the Middle East is once again seeing rising tensions. A refinery in Iraq’s north was hit by a rocket, causing a fire, according to Al-Arabiya television. That comes after Iran accused Israel and the U.S. of being behind the assassination of one of its top nuclear scientists Friday, vowing revenge.

©2020 Bloomberg L.P.