Aug 25, 2019

Oil Declines for a Fourth Day After Escalation in Trade War

, Bloomberg News

(Bloomberg) -- Oil fell for a fourth day, the longest run of declines in more than five weeks, as an escalation in the U.S.-China trade war worsened an already shaky global demand outlook.

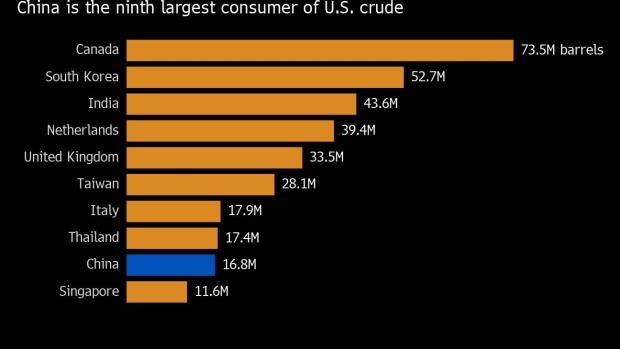

Futures in New York fell 1.8% after closing down 2.1% on Friday as Beijing said it would put retaliatory tariffs on another $75 billion of U.S. goods including -- for the first time -- oil. President Donald Trump then announced tariff increases on Chinese goods after crude markets had closed, and also called for American companies to pull out of Asia’s largest economy.

The sharp deterioration in trade relations between the two countries wrong-footed oil investors. Short-sellers slashed wagers by 25% in the week through Aug. 20 that West Texas Intermediate oil would decline, according to data released Friday.

To contact the reporter on this story: Andrew Janes in Singapore at ajanes@bloomberg.net

To contact the editors responsible for this story: Serene Cheong at scheong20@bloomberg.net, James Thornhill, Keith Gosman

©2019 Bloomberg L.P.