Feb 14, 2023

Oil declines on U.S. requirement to sell more crude from the SPR

, Bloomberg News

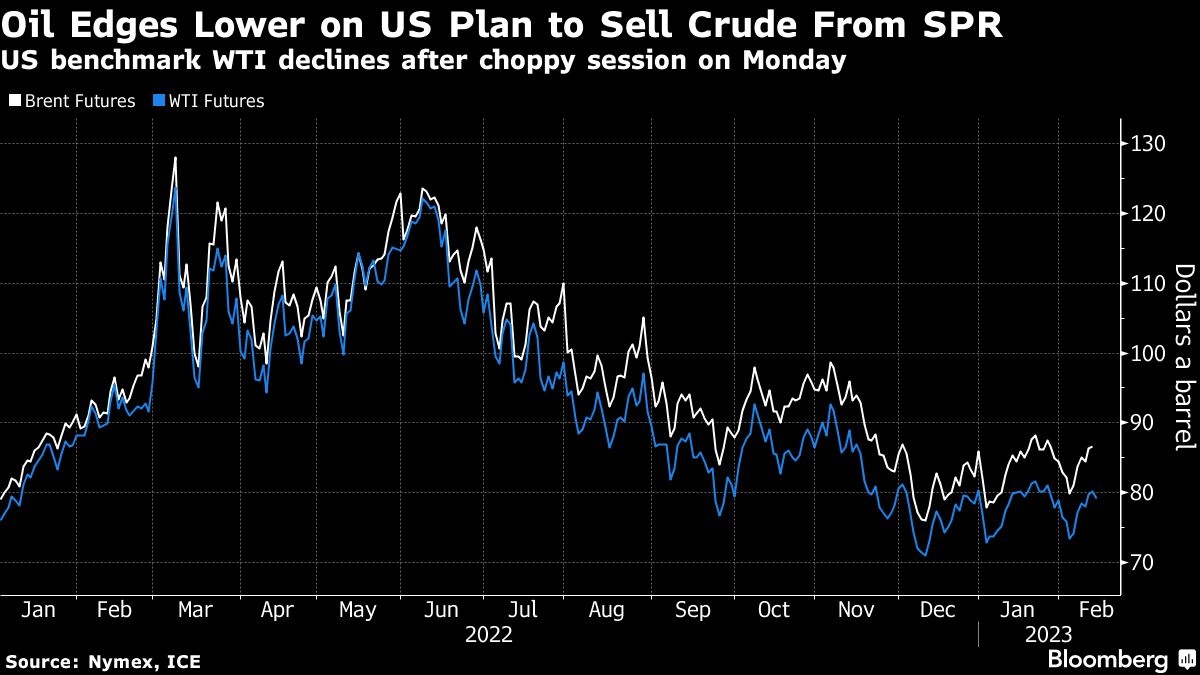

Oil fell on a U.S. requirement to sell more crude from reserves, offsetting a lift from Russian output cuts and rising Chinese demand.

West Texas Intermediate dropped toward US$79 a barrel after a volatile session Monday. The U.S. is looking to sell 26 million barrels from the Strategic Petroleum Reserve in accordance with a budget mandate enacted in 2015.

The decline in crude comes ahead of the release of crucial U.S. inflation data later Tuesday that’ll shape investor expectations for how high the Federal Reserve will push interest rates to bring inflation back under control.

Oil has had a mixed start to 2023 as traders attempt to price the demand impact of China’s re-opening, the supply curbs announced by Moscow amid the war in Ukraine, and persistent concerns that tighter U.S. monetary policy may trigger a recession. At the same time, the Organization of Petroleum Exporting Countries and its allies have been pressing on with cutbacks in output amid concerns around oil supply, according to the UAE’s energy minister.

More U.S. crude sales should not have a protracted impact on prices, according to Tamas Varga, an analyst at PVM Oil Associates Ltd. “U.S. inflation data will give some food for thought to investors. If it comes in worst than expected, the market will expect rates to be higher for longer and that will push equities lower and therefore oil lower.”

Prices:

- WTI for March delivery fell 1.4 per cent to US$79.02 a barrel on the New York Mercantile Exchange at 10:12 a.m. in London.

- Brent for April settlement was one per cent lower at US$85.74 a barrel on the ICE Futures Europe exchange.

The Biden administration ordered an unprecedented release from the SPR last year to combat the inflationary fallout from the war in Ukraine, which included soaring gasoline prices. Since then, the Energy Department has sought to stop some of the sales so the reserve can be refilled.

OPEC is due to issue its monthly market snapshot later on Tuesday, offering traders fresh insight into the cartel’s view of supply and demand over 2023.