Dec 22, 2021

Oil Demand Recovery Supports Stock Market’s Bullish Momentum

, Bloomberg News

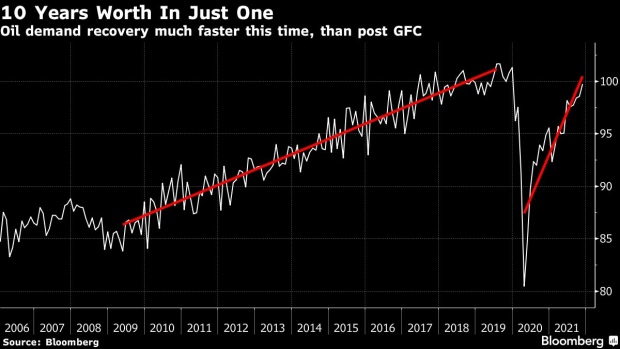

(Bloomberg) -- The stock market’s speedy recovery from the 2020 crash and the more-or-less steady ascent ever since has been hailed as not only historic, but a sign of overheating. Yet perhaps stock bulls were right after all, at least according to oil demand as an indication of economic growth.

Oil demand isn’t alone in showing that pattern. The stock market also posted the fastest recovery in history. After the 35% drop in the S&P 500 last year, it only took five months for the U.S. equity benchmark to recover those gains. Even after two technical corrections in the back half of the 2020, and shallow pullbacks in 2021, stocks are often hailed as over exuberant or overheated.

But if the asset class is meant to measure economic growth, perhaps it’s doing just that since oil demand reflects a similar dynamic. After all, the 40-day correlation between stocks and oil prices has been historically high. In other words, the oil market can serve as a roadmap for the stock market because both are meant to measure underlying growth. For investors, the question in 2022 will be whether a deceleration in global economic growth starts to hurt both oil and stocks, or whether the two risk assets keep climbing, just at a slower pace.

©2021 Bloomberg L.P.