Nov 8, 2022

Oil drops as swelling COVID cases in China blunt demand outlook

, Bloomberg News

Tight oil supply points to higher prices: Horizons ETFs manager

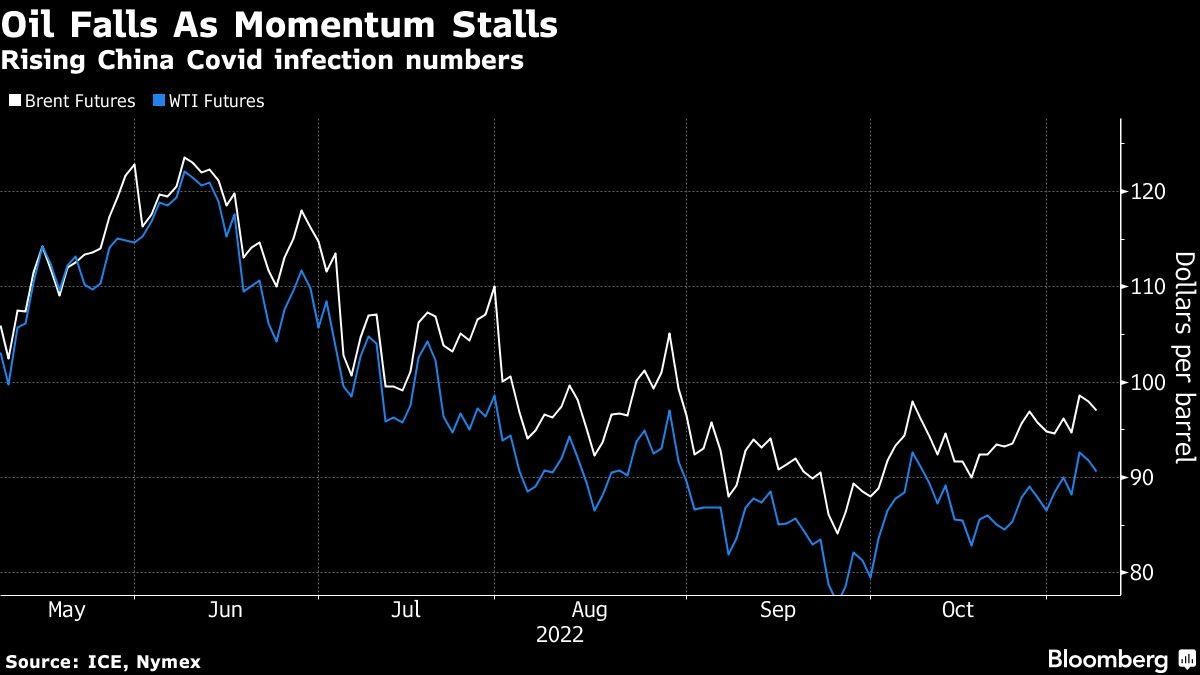

Oil fell as China’s renewed commitment to strict Covid-19 policies overshadowed a global market backdrop of shrinking fuel inventories.

West Texas Intermediate fell 3.1 per cent to settle below US$89 barrel, while Brent futures traded below US$96 barrel. The week started on a dour note as China reaffirmed its commitment to its Covid Zero strategy, which includes demand-sapping movement curbs and lockdowns.

Despite the fall, oil has remained within a relatively narrow range, with lackluster trading volumes rendering futures especially susceptible to macro-market moves. Momentum for buying has stalled at the moment, while the market enters a wait-and-see mode, traders said.

Meanwhile, the outlook for fuel inventories has tightened after OPEC+ recently slashed output and ahead of ban on Russian exports. Dwindling fuel stockpiles has bolstered the global benchmark’s recent rally toward US$100, and Dated Brent --the world’s most important physical oil price, rose above US$100 a barrel for the first time since August, according to S&P Global Platts which publishes the benchmark.

“Brent crude is hovering below the US$100 a barrel level for now but it seems the oil market is convinced it is one headline away from breaking above that key barrier,” said Ed Moya, senior market analyst at Oanda Corp. “Energy traders still remain confident that the oil market is still going to remain tight throughout this winter even if China’s reopening is slightly delayed.”

Prices:

- WTI for December delivery fell US$2.88 to settle at US$88.91 a barrel in New York

- Brent for January settlement fell US$2.36 to US$95.36 a barrel.