May 30, 2023

Oil declines amid risk-off mood as traders monitor U.S. debt deal

, Bloomberg News

We will have the lowest oil inventories in at least 5 years by end of 2023: Eric Nuttall

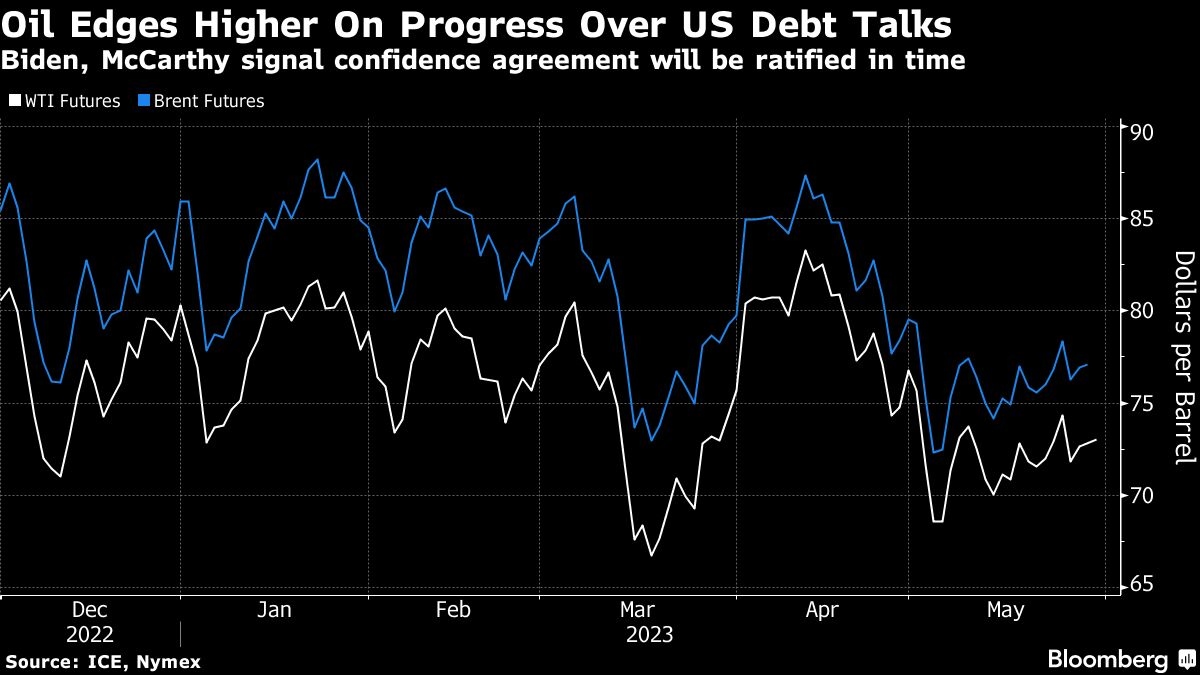

Brent oil declined with other commodities as a risk-off tone in Asia overshadowed progress toward a US debt-ceiling agreement.

The global benchmark fell toward US$76 a barrel, with a stronger dollar making commodities priced in the currency such as oil and copper less attractive to investors. A key gauge of Chinese stocks was also on track to enter a bear market, in part due to a sluggish economic recovery.

White House and Republican congressional leaders stepped up lobbying efforts to win approval for a deal to avert a U.S. default, with President Joe Biden and House Speaker Kevin McCarthy signaling confidence in the progress.

Oil is around 11 per cent lower this year as China's lackluster economic recovery following the end of COVID Zero and the Federal Reserve's aggressive monetary tightening campaign weighed on the demand outlook. Russian supply has also been resilient, even after the nation said it would cut output.

Traders will be on the lookout for further signals about supply from the OPEC+ coalition before the group meets June 3-4 to set its output policy. Saudi Arabia and Russia recently offered conflicting signals on the potential for the collective to alter its production levels.

“Economic data thus far continues to be presented with downside risks,” said Yeap Jun Rong, a market strategist for IG Asia Pte, adding that robust Russian output is also keeping a lid on oil. Questions remain over what will underpin a more sustained price rally, he said.

Prices:

- Brent for July settlement fell 0.6 per cent to US$76.63 a barrel at 7:28 a.m. in London after rising as much as 0.7 per cent earlier.

- West Texas Intermediate for July delivery slipped 0.4 per cent from Friday's close to US$72.41 a barrel.

- There was no settlement on Monday due to the U.S. holiday and trades will be booked Tuesday.