Mar 30, 2020

Oil ETF Seen as ‘Tourist Trap’ With Crude Prices in the $20s

, Bloomberg News

(Bloomberg) -- If they’re not careful, investors pouring cash into the biggest exchange-traded fund tracking crude prices are going to get burned.

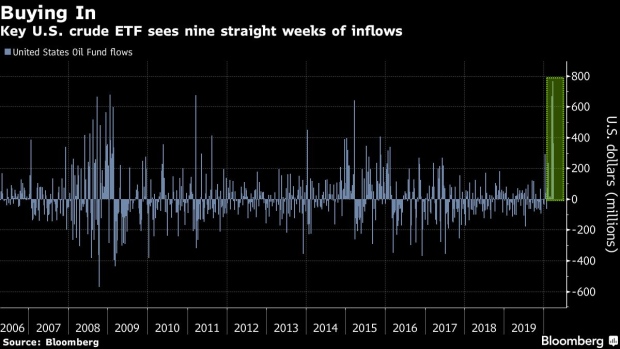

Savvy investors typically use the United States Oil Fund to make bets on short-term price reversals, buying dips and selling rallies. About $1.8 billion flowed into USO over the last three weeks, marking the biggest consecutive weekly inflows on record, data compiled by Bloomberg show. The inflows have likely helped to support the futures market at a time when oversupply has driven U.S. benchmark crude prices more than 60% lower since the start of the year.

But a pricing structure in the oil market known as contango, where current oil futures contracts are priced lower than the next month, will derail profits for any longer-term investors. The fund would lose money in a contango market when it sells the futures as they near their expiry on April 21 and buys the next month.

“When you buy this ETF, the timer starts and it just slowly but surely eats away at your return,” said Eric Balchunas, an ETF analyst for Bloomberg Intelligence. “What you have to worry about is when oil gets too low or too high, it attracts the tourist types. This is a tourist trap.”

While futures prices have been held up by activity in USO, the physical market is facing a larger-scale breakdown as the coronavirus outbreak hits demand and Saudi Arabia and Russia vie over market share, with Riyadh planning to bump up its oil exports in the coming months.

Front-month West Texas Intermediate crude futures tumbled nearly 50% during the last three weeks of March, while a measure of the volatility of the ETF skyrocketed above 190% earlier this month before slightly retracing, attracting investors who are betting on a rebound in crude. The ETF’s value dropped almost 50% over the last three weeks.

WTI fell $1.46 to $20.05 a barrel at 1:31 p.m. in New York on Monday.

Yet, the fund’s activity does show it’s mostly being used as a short-term trading vehicle. USO has just under $2 billion in assets and a little over $500 million exchanged hands on Friday. At least about a quarter has traded each day during March.

(Updates seventh paragraph with WTI prices.)

©2020 Bloomberg L.P.