Sep 16, 2019

Oil ETF Sees Biggest Trading Spike Since January on Saudi Attack

, Bloomberg News

(Bloomberg) -- An attack on Saudi Arabian oil facilities is disrupting global supplies and is sending trading in exchange-traded funds exposed to the sector through the roof.

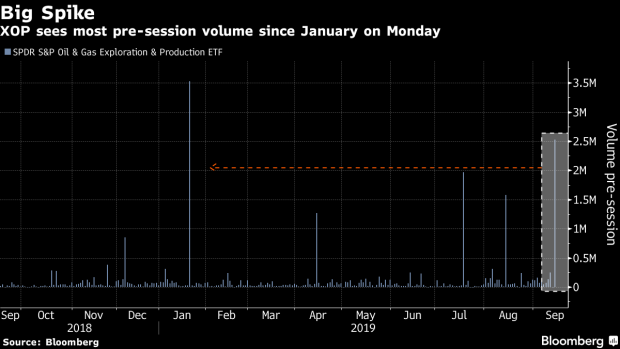

More than 2.6 million shares of the SPDR S&P Oil & Gas Exploration & Production ETF, or XOP, changed hands before stock markets opened in New York on Monday, data compiled by Bloomberg show. That’s more than 19 times the average pre-session volume for the past year and the most since January for the $1.62 billion fund.

Oil notched its biggest intraday jump on record, at one point surging above $71 a barrel, after a strike on a Saudi Arabian oil facility removed about 5% of global supplies. The hit highlighted the vulnerability of the world’s most important exporter and raised the specter of further destabilization in the region. President Donald Trump promised to help allies following the attack and authorized releasing oil from U.S. strategic reserves.

“As unexpected as the weekend’s events were, to us it is more of a wake-up call about the energy sector than a sign that macro investment narratives are about to change dramatically,” Nicholas Colas, co-founder of DataTrek Research, wrote in a note. “It’s not the best-structured industry around and its growth prospects may be poor, but the world still uses 100 million barrels of oil a day. And when a few million of those barrels go offline, even temporarily, it’s hard not to notice.”

Elsewhere, the United States Oil Fund, ticker USO, saw its second-largest inflow of the year on Friday, with investors adding $98 million. Pre-session trading in USO also spiked, reaching its highest since December, with more than 5.2 million shares exchanging hands.

To contact the reporters on this story: Vildana Hajric in New York at vhajric1@bloomberg.net;Sarah Ponczek in New York at sponczek2@bloomberg.net

To contact the editors responsible for this story: Jeremy Herron at jherron8@bloomberg.net, Dave Liedtka, Randall Jensen

©2019 Bloomberg L.P.