May 27, 2018

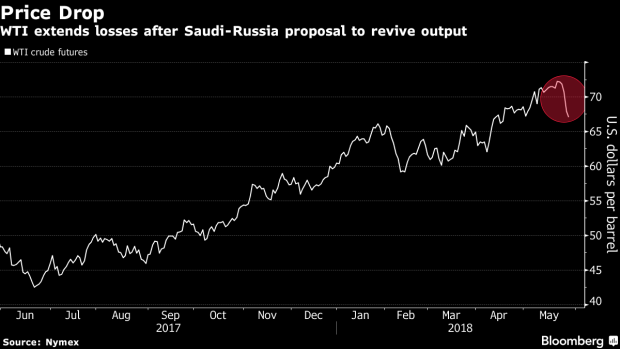

Oil Extends Decline After Saudi-Russia Proposal to Revive Output

, Bloomberg News

(Bloomberg) -- Oil extended losses below $66 a barrel after Saudi Arabia and Russia proposed easing output curbs after eliminating an inventory surplus that had sparked a the biggest price crash in a generation.

Futures in New York fell as much as 3.1 percent after dropping the most in almost 11 months in the previous session. Saudi Arabian Energy Minister Khalid Al-Falih said Friday that discussions with Russia to ease supply cuts are underway although no decision has been made yet. However, officials from several producers, both inside and outside the group, said they disapproved of the proposal to raise output.

Oil earlier this month rose to the highest level in more than three years after President Donald Trump’s decision to reimpose sanctions on Iran and plunging Venezuelan output fueled supply concerns. With OPEC and allies achieving a key goal of eliminating the global surplus despite record production in the U.S., traders now are weighing whether Saudi Arabia and Russia will go ahead with their plan to revive output without reaching consensus with allies. The group are set to meet in June to decide its next steps.

“The latest signal from OPEC and Russia cooled down expectations for the group’s cuts, which have been a major factor boosting crude price since late last year,” Satoru Yoshida, a commodity analyst at Rakuten Securities Inc., said by phone from Tokyo. “If OPEC and allies decide at the June meeting to maintain their production cuts through December and ease anxiety among investors, crude prices may rebound.”

West Texas Intermediate for July delivery fell as much as $2.08 to $65.80 a barrel on the New York Mercantile Exchange and traded at $65.97 at 10:54 a.m. in Tokyo. There is no settlement Monday because of the U.S. Memorial Day holiday. Trades will be booked Tuesday for settlement purposes. Prices dropped $2.83 to $67.88 on Friday. Total volume traded was about 102 percent above the 100-day average.

Brent futures for July settlement dropped as much as $1.95 to $74.49 a barrel on the London-based ICE Futures Europe exchange. Prices on Friday lost $2.35 to $76.44. The global benchmark crude traded at a $8.83 premium to WTI for the same month, on course for the widest close since March 2015.

Futures for September delivery fell 3.8 percent to 459.1 yuan a barrel on the Shanghai International Energy Exchange. The contract dropped 1.6 percent to 477.4 yuan on Friday.

To contact the reporter on this story: Tsuyoshi Inajima in Tokyo at tinajima@bloomberg.net

To contact the editors responsible for this story: Pratish Narayanan at pnarayanan9@bloomberg.net, Anna Kitanaka, Sungwoo Park

©2018 Bloomberg L.P.