Sep 17, 2019

Oil Extends Drop as Saudi Output Restoration Calms Market Fears

, Bloomberg News

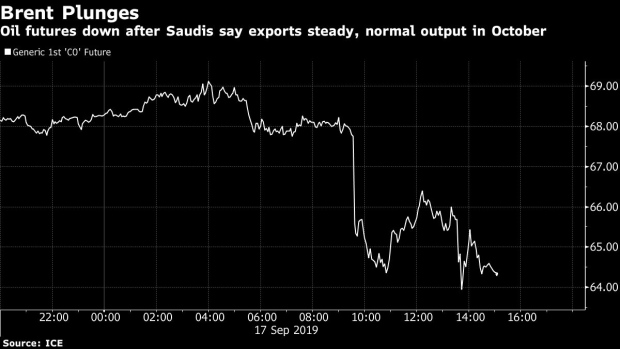

(Bloomberg) -- Oil extended its pullback after a spectacular start to the week on signs Saudi Arabia is restoring production following a debilitating weekend attack on key installations.

Brent futures edged lower in early Asia trade on Wednesday after tumbling 5.7% as Saudi Aramco said it had revived 41% of capacity at a key crude-processing complex days after a devastating aerial attack that wrecked vital equipment and rocked global energy markets. The global oil benchmark, which jumped to just shy of $72 a barrel in reaction to the disruptions, was back to about $64.

The announcement followed conflicting media reports about the pace and probable duration of Saudi Aramco’s efforts to repair the damaged Abqaiq facility. Despite the kingdom’s reassurances at a media briefing in Jeddah, crude remained almost 7% higher than the pre-attack price, a signal of the risk premium factored in by traders.

The question of how the U.S. and Saudi Arabia will respond to the attack on Abqaiq and an important oil field, which Secretary of State Mike Pompeo has blamed on Iran, still hangs over the market. The Pentagon is preparing an assessment on who was responsible for the strike and hopes to make it public, a U.S. defense official said.

“The market is certainly setting itself up for a surprise, considering they aren’t really pricing in that geopolitical risk premium at the moment,” said Daniel Hynes, a senior commodity strategist at Australia & New Zealand Banking Group Ltd. in Sydney.

The Saudis pledged to lift output capacity to 11 million barrels a day by the end of this month and to 12 million in November, Energy Minister Prince Abdulaziz bin Salman said at the briefing. Customers will be getting their supplies, and Aramco will tap reserves if needed, he said.

Adding to the bearish sentiment, the industry-funded American Petroleum Institute reported a 592,000-barrel increase in stockpiles for the week ended Sept. 13, in contrast with analyst expectations for a 2.25 million-barrel drop. If government data Wednesday confirms the increase, it would break a four-week streak of inventory declines. The API also reported an 846,000-barrel drop in stocks at Cushing, Oklahoma, and a combined 3.6 million barrel build in gasoline and distillate inventories, according to people familiar with the data.

Brent for November delivery fell 28 cents, or 0.4%, to $64.27 a barrel on the ICE Futures Europe exchange at 8:52 a.m. in Singapore. It tumbled by 6.5% Tuesday after surging 14.6% on Monday.

West Texas Intermediate for October delivery was down 34 cents, or 0.6%, at $59.00 a barrel on the New York Mercantile Exchange. The U.S. benchmark’s discount to Brent for the same month was $5.46 a barrel.

Meanwhile, U.S. President Donald Trump said he saw no reason to allow refiners to dip into the nation’s emergency reserves. “I don’t think we need to. Oil has not gone up very much,” Trump told reporters Tuesday aboard Air Force One. “There’s a lot of oil in the world.“

Saudi Aramco is firing up idle offshore oil fields -- part of its cushion of spare capacity -- to replace some lost production, a person familiar with the matter said. Some customers are being asked to accept different grades of crude. The kingdom’s domestic inventories are sufficient to cover about 26 days of exports, according to consultant Rystad Energy A/S.

--With assistance from Joe Carroll, James Thornhill, David Marino and Sheela Tobben.

To contact the reporter on this story: Saket Sundria in Singapore at ssundria@bloomberg.net

To contact the editors responsible for this story: Serene Cheong at scheong20@bloomberg.net, Andrew Janes, Alexander Kwiatkowski

©2019 Bloomberg L.P.