Mar 29, 2023

Oil rally stalls as weak fuel demand halts momentum buying

, Bloomberg News

The oil market is oversold: Analyst

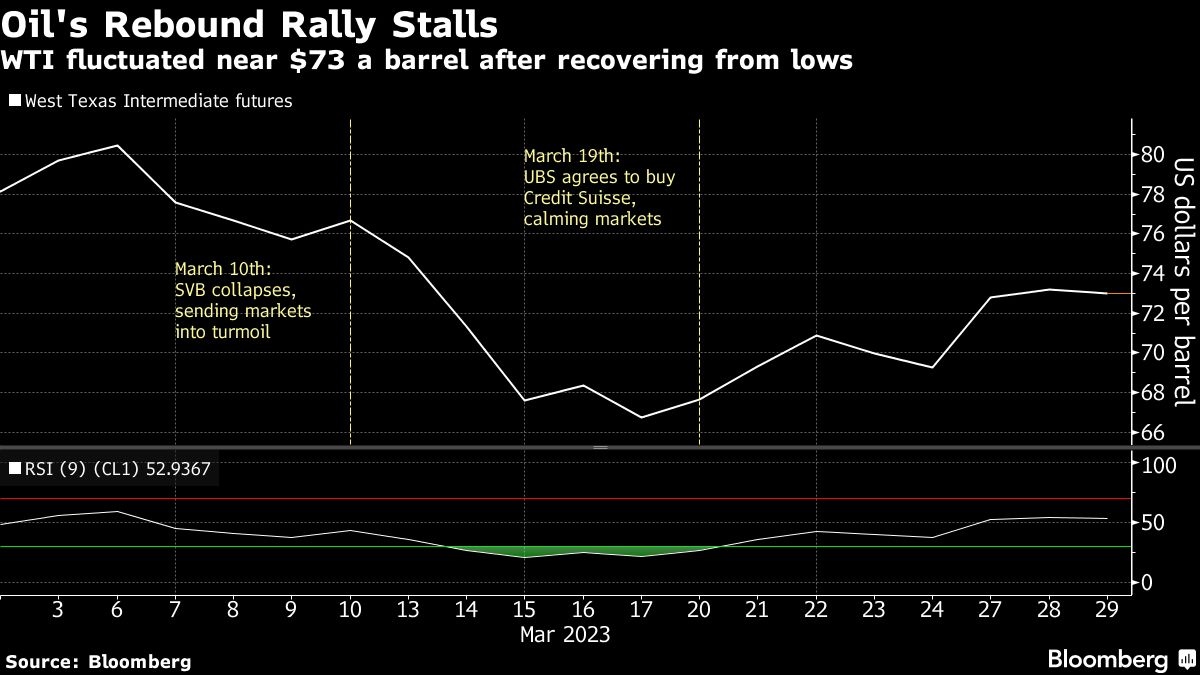

Oil’s rebound rally stalled in its third day as lagging fuel demand undercut a wave of algorithmic buying.

West Texas Intermediate edged lower to settle below US$73 a barrel amid slumping distillate futures. Demand for diesel, which is used as both an industrial and heating fuel, continues to languish at seven-year seasonal lows, a sign of lackluster economic activity.

“We are in a softer period seasonally and we have had a mild winter in the Northeast, so I am not surprised that there is weakness there,” said Rebecca Babin, a senior energy trader at CIBC Private Wealth.

Earlier, oil rose above US$74 a barrel after a government report showed U.S. stockpiles fell more than 7 million barrels last week. Momentum-driven commodity trading advisors helped prop crude’s rebound rally as traders bought back into oil futures.

Oil has been buttressed by supply risks and resurgent demand from China as the nation recovers from pandemic lockdowns. Uncertainty though continues to weigh on the market, following a banking crisis that has hit institutions in both the U.S. and Europe.

Prices:

- WTI for May delivery declined 23 cents to settle at US$72.97 a barrel in New York.

- Brent for May settlement fell by 37 cents to settle at US$78.28 a barrel.