Apr 24, 2019

Oil Extends Loss After Larger-Than-Expected U.S. Inventory Gain

, Bloomberg News

(Bloomberg) -- Oil extended losses below $66 a barrel after U.S. crude inventories rose more than expected, hampering a rally driven by the prospect of tighter supplies due to American sanctions on Iran.

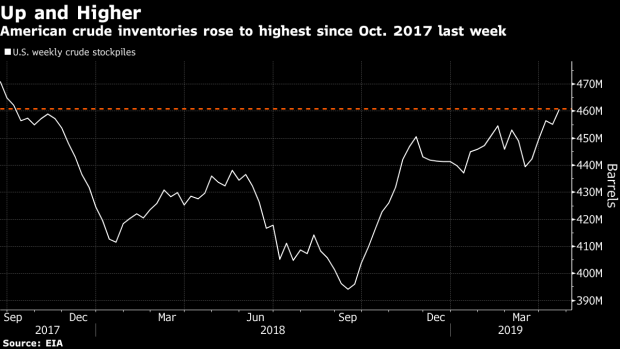

Futures in New York were down by about 0.5 percent after posting the biggest drop in more than a week on Wednesday. Government data showed U.S. stockpiles rose 5.48 million barrels last week, compared with an increase of 1 million barrels forecast in a Bloomberg survey. The gain was the fourth in the past five weeks, pushing the total to the highest level since October 2017.

While the surge in U.S. supplies snapped this week’s rally spurred by Washington’s move to end waivers from sanctions on Iranian oil, prices are still set for an eighth straight week of gains. Crude’s up 40 percent this year, helped by the OPEC+ coalition’s mission to curtail output. Investors will watch how the cartel responds when the exemptions expire May 2. Saudi Arabia’s Energy Minister Khalid Al-Falih has said he sees no need for immediate action.

“Oil markets were trading much more defensively especially after the U.S. inventory data undermined the exceedingly-tight supply narrative that traders have been running with,” according to Stephen Innes, head of trading and market strategy at SPI Asset Management. “But ultimately how high oil prices go from here will depend on what degree oil markets tighten, mostly from the supply response from the OPEC+ coalition group.”

WTI for June delivery declined as much as 35 cents to $65.54 a barrel on the New York Mercantile Exchange and traded at $65.55 at 9:39 a.m. in Singapore. Prices lost 41 cents on Wednesday, trimming gains from the rally in the first two sessions of the week to 2.4 percent.

Brent for June settlement dropped 22 cents to $74.32 a barrel on the London-based ICE Futures Europe exchange. It ended little changed at $74.57 on Wednesday. The global benchmark crude was at a premium of $8.76 to WTI.

--With assistance from Tsuyoshi Inajima.

To contact the reporter on this story: Sharon Cho in Singapore at ccho28@bloomberg.net

To contact the editors responsible for this story: Pratish Narayanan at pnarayanan9@bloomberg.net, Ovais Subhani

©2019 Bloomberg L.P.