Feb 7, 2023

Oil climbs most since November on Saudi price hike to Asia

, Bloomberg News

Expect an increase in demand for oil from China in mid-2023: Andrew Lipow

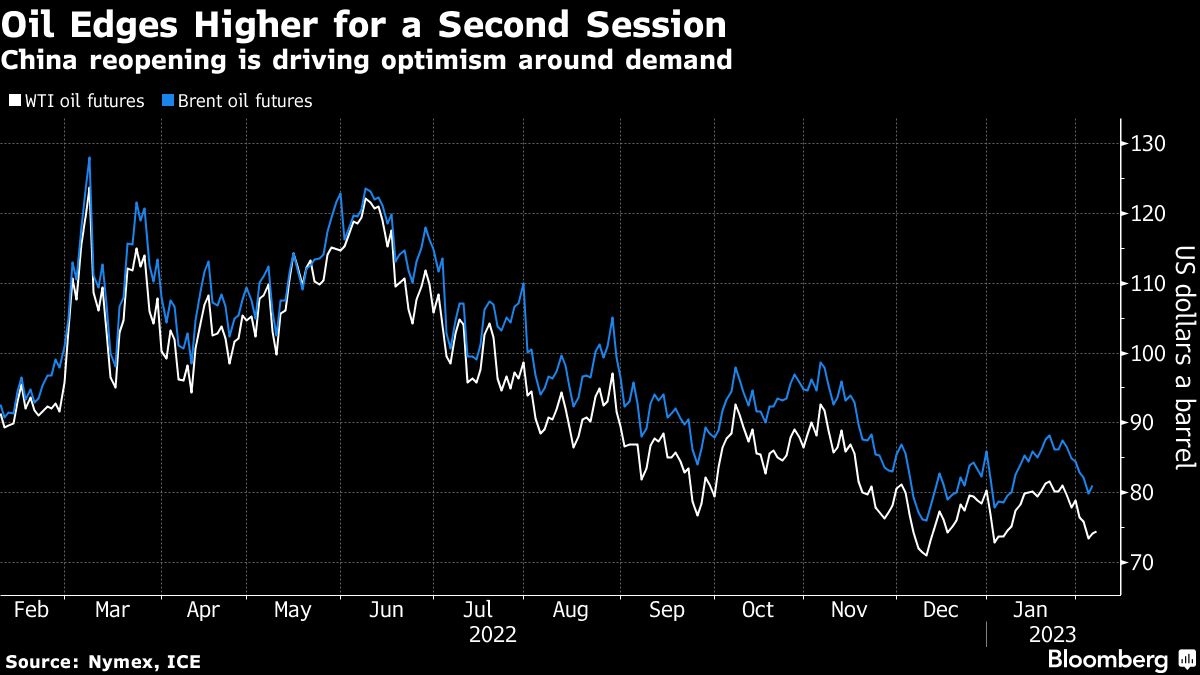

Oil jumped the most since early November as investors grew more confident in China’s demand outlook.

The more-than-three dollar boost to West Texas Intermediate on Tuesday followed on the heels of Saudi Aramco increasing most of its official selling prices for shipments to Asia in March. Oil’s rally accelerated late in the session as Wall Street investors responded positively to Federal Reserve Chair Jerome Powell’s comments Tuesday.

Oil has fluctuated in a relatively narrow US$10 range so far this year. While traders are awaiting more signs of stronger Chinese demand, indications of oversupply are tempering optimism in the near term. Those who watch oil closely will be tuning in Wednesday for the Energy Information Administration’s release of weekly inventory data.

“In the grand scheme, essentially you have contrasting forces of rising inventories and a bullish outlook on demand,” said Daniel Ghali, a commodity strategist at TD Securities.

Prices

- WTI for March delivery rose US$3.03 to settle at US$77.14 a barrel in New York.

- Brent for April settlement rose US$2.70 to settle at US$83.69 a barrel.