Dec 16, 2022

Oil falls as recession fears outweigh modest SPR buyback plan

, Bloomberg News

Oil Markets Seeing 'Soft Patch,' BofA's Blanch Says

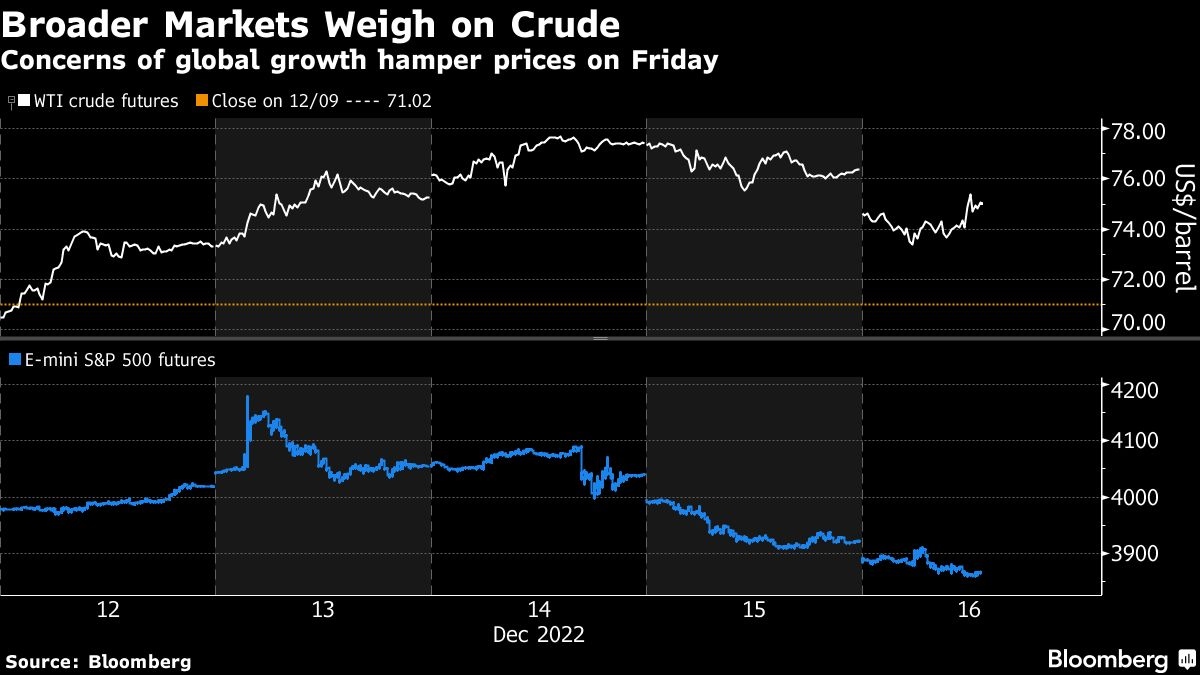

Fears of a global economic slowdown pushed oil prices lower, outweighing news that the Biden administration will start buying crude to replenish strategic reserves.

West Texas Intermediate fell 2.4 per cent to settle around US$74 a barrel on Friday. Oil fell in tandem with broader markets as apprehension grows the resolve of central banks to fight against inflation will tip economies into recession. Adding more weight to prices, portions of the Keystone pipeline have resumed flows at reduced pressure, supplying Canadian crude to US Midwest refineries.

Oil’s historic volatility this year has carried into the end of the year with crude shedding almost US$20 in the past two months. Bulls fled from positions as slack demand for physical barrels and unexpectedly resilient Russian supplies weighed on prompt prices for benchmark crude. While the outlook brightened somewhat in recent days as US inflation figures slowed and China looked set to reopen its economy, central banks’ determination to stick to higher interest rates quashed optimism.

The sustained dip into the US$70 range prompted the Biden administration to make good on its promise to replenish the nation’s emergency oil reserves, starting with a three million barrel purchase of crude for February. The plan briefly jolted oil prices but was quickly digested by the market with the 3 million barrel purchase paling in comparison to the 180 million that were released.

Prices:

- WTI for January delivery fell US$1.82 to US$74.29 a barrel in New York.

- Brent for February settlement dropped fell US$2.17 to US$79.04 a barrel.