Oct 24, 2022

Oil pares losses as focus turns to earnings for economic clues

, Bloomberg News

We've entered an oil market that's policy driven: Michael Tran

Oil pared losses as the market’s focus shifted from the conclusion of China’s party congress to a raft of major earnings scheduled this week.

West Texas Intermediate hovered near US$85 as traders remained glued to the outlook for economic growth and further central rate hikes. Earlier Monday, crude slipped below US$83 a barrel as investors digested Chinese economic data that showed a mixed recovery during the third quarter. While choppy, U.S. equity market remained aloft with earnings season so far showing company profits withstanding fears about future slowdowns.

A lot of people are talking about a potential recovery in equity markets, rallying oil from earlier lows, said Robert Yawger, director of the futures division at Mizuho Securities USA in New York. “The people that trade energy don’t want to be left out in the cold on a nice juicy rally.”

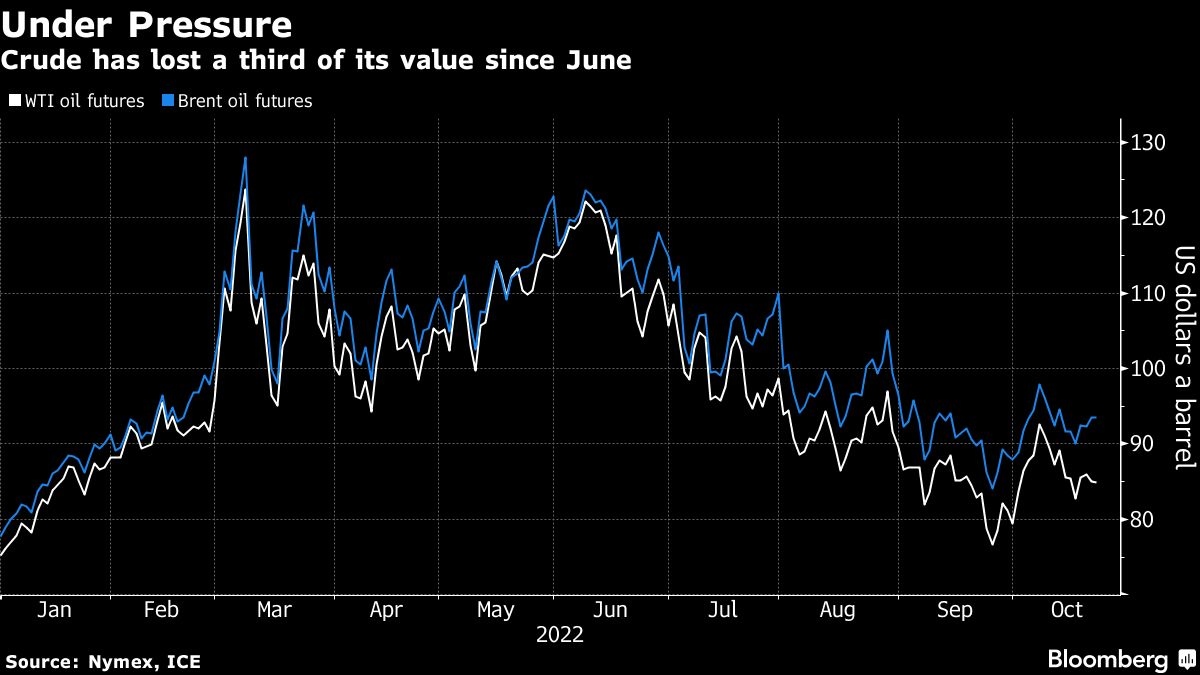

Crude has lost a third of its value since June as fears over a global economic slowdown continue to hang over the market. However, significant OPEC+ output cuts and looming European Union sanctions on Russian oil flows have raised concerns about an energy crunch heading into winter. For now though, traders remained glued to the outlook for economic growth and further central bank hikes.

The decision by the Organization of Petroleum Exporting Countries and its allies to curb supply from November drew a sharp rebuke from the U.S., which previously called on producers for more oil to help curb inflation. President Joe Biden’s top energy adviser said Sunday the cut was largely a political move.

Brent futures remained backwardated, a bullish structure where near-dated contracts are more expensive than later-dated ones. The prompt time spread widened to as much as US$2.25 in backwardation, compared with US$1.44 a week earlier.

Prices

- WTI for December delivery fell 41 cents to US$84.64 a barrel at 11:29 a.m. in New York.

- Brent for December settlement dipped 32 cents to US$93.18 a barrel.

Substantial headwinds for oil continue to emanate from China. The potential for rebounding Chinese demand dimmed as President Xi’s leadership changes have “fueled speculation that tackling Covid and maintaining national security are being prioritized above economic considerations, which is depressing the oil demand outlook,” said Harry Altham, an analyst at brokerage StoneX Group. China also recently imposed Covid-19 curbs in Guangzhou, a southern Chinese manufacturing hub.

China ramped up its oil imports and processing last month as refineries returned from seasonal maintenance, while exports of fuel products jumped after the allocation of new quota. Inbound shipments rose to the highest since May, according to Bloomberg calculations based on government data.