May 23, 2019

Oil falls below US$60 on rising U.S. inventories and trade tension

, Bloomberg News

Oil in New York fell below US$60 a barrel for the first time since March after a surprise jump in American crude inventories alleviated concerns over a supply crunch, while fears of a full-blown trade war between the U.S. and China weighed on the outlook for demand.

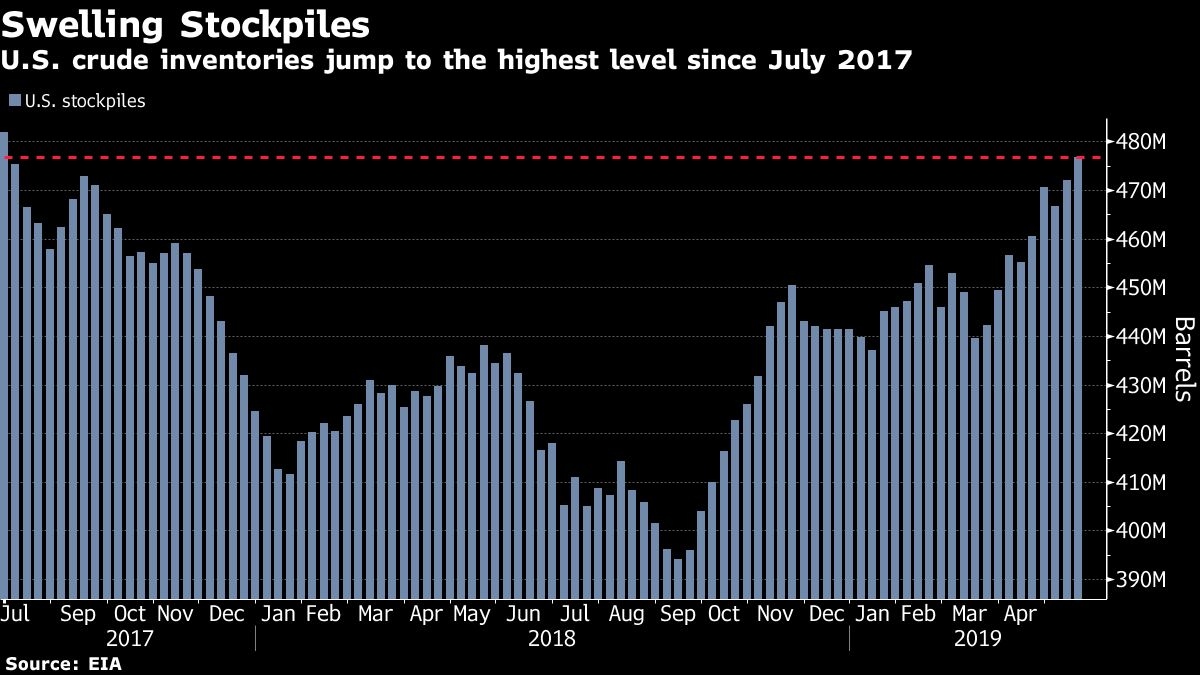

Futures fell as much as 2.4 per cent in New York, and in London Brent crude fell below US$70 a barrel. American stockpiles rose by 4.7 million barrels last week to the highest level since mid-2017, despite expectations for a decline, while fuel inventories also climbed. Global equities weakened after the White House was considering cutting off the flow of vital U.S. technology to five Chinese surveillance companies.

Oil is on course for its first monthly loss this year after a dramatic escalation in the trade dispute between the world’s two biggest economies jeopardized the outlook for global growth. While there’s no shortage of supply risks -- including the possibility that the Organization of Petroleum Exporting Countries will extend its output curbs or that rising tension in the Middle East will disrupt energy flows -- swelling U.S. stockpiles are mitigating those concerns.

“Neither renewed Middle East tensions nor the possibility of extending OPEC+ output cuts has managed to bump crude oil from its tight range,” said Ole Sloth Hansen, head of commodity strategy at Saxo Bank A/S in Copenhagen. “Worries about the impact of the trade war on global economic growth as well as a stubbornly strong dollar” are capping prices.

West Texas Intermediate crude for July delivery fell US$1.39 to US$60.03 a barrel on the New York Mercantile Exchange at 1:29 p.m. London time. Earlier it slipped to US$60.79, the lowest since May 14. The contract dropped 2.7 per cent on Wednesday, the biggest drop in almost three weeks.

Brent for July settlement declined US$1.76 to US$69.23 a barrel on the London-based ICE Futures Europe exchange. It’s the first time the contract has fallen below US$70 since May 14. The global benchmark crude was at a US$9.40 premium to WTI.

Along with the increase in U.S. crude inventories, Energy Information Administration data released Wednesday showed gasoline and distillate stockpiles also defied forecasts to rise last week. American crude production climbed by 100,000 barrels a day to 12.2 million barrels a day, near the record-high reached last month.

Other oil-market news:

Saudi Aramco’s deal to buy a stake in a U.S. gas-export project is a sign the kingdom may be willing to support crude-production cuts for longer as it seeks to reduce economic reliance on oil, according to Brookfield Asset Management Inc.

The full restart of Russia’s vital crude-oil export pipeline to Europe is being delayed as Poland presses for compensation for tainted supplies it received before the link was halted. Nevertheless, deliveries of clean Russian crude did reach Slovakia earlier on Thursday, according to people familiar with the matter.

--With assistance from James Thornhill