Dec 10, 2019

Oil Falls From 12-Week High as Report Shows U.S. Stockpile Build

, Bloomberg News

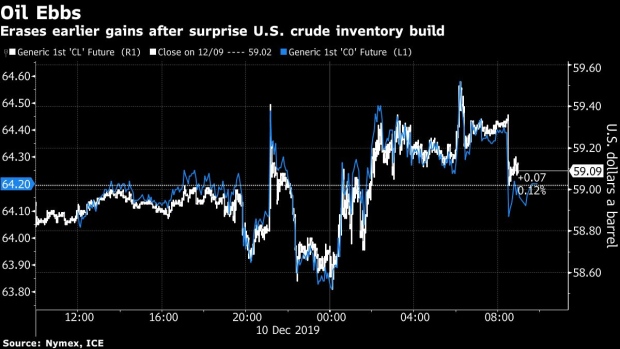

(Bloomberg) -- Oil retreated from its highest close in almost three months after an industry report showed American crude inventories expanded last week, adding to concerns over weakening demand.

Futures in New York dropped as much as 0.6% after climbing 0.4% on Tuesday. The American Petroleum Institute reported U.S. stockpiles grew by 1.41 million barrels, according to people familiar with the data. Chinese officials expect the U.S. to delay a tariff increase scheduled for Sunday, giving more time to negotiate an interim trade deal, people with familiar with the discussions said.

Crude has been hovering around the highest levels since mid-September after the Organization of Petroleum Exporting Countries and its allies surprised the market on Friday by announcing deeper-than-forecast production cuts for next year. While there’s optimism a limited trade deal is close, there’s still a lot of uncertainty. White House Trade Adviser Peter Navarro told Fox Business Network that China is trying to “shape the narrative” on trade talks.

“On top of data that suggests an inventory build in the U.S., the Dec. 15 deadline for the imposition of new U.S. tariffs on Chinese goods is rapidly approaching,” said Stephen Innes, chief Asia market strategist at AxiTrader Ltd. “Although there are indications that both sides are looking for a resolution, concerns will linger until that is finally announced.”

West Texas Intermediate for January delivery fell 32 cents, or 0.5%, to $58.92 a barrel on the New York Mercantile Exchange as of 9:29 a.m. in Singapore. The contract settled 22 cents higher at $59.24 on Tuesday, the highest close since Sept. 17.

Brent for February settlement dropped 0.6% to $63.94 a barrel on the London-based ICE Futures Europe Exchange. The global benchmark crude traded at a $5.12 premium to WTI for the same month.

--With assistance from James Thornhill.

To contact the reporter on this story: Sharon Cho in Singapore at ccho28@bloomberg.net

To contact the editors responsible for this story: Serene Cheong at scheong20@bloomberg.net, Andrew Janes, Ben Sharples

©2019 Bloomberg L.P.