Jun 15, 2022

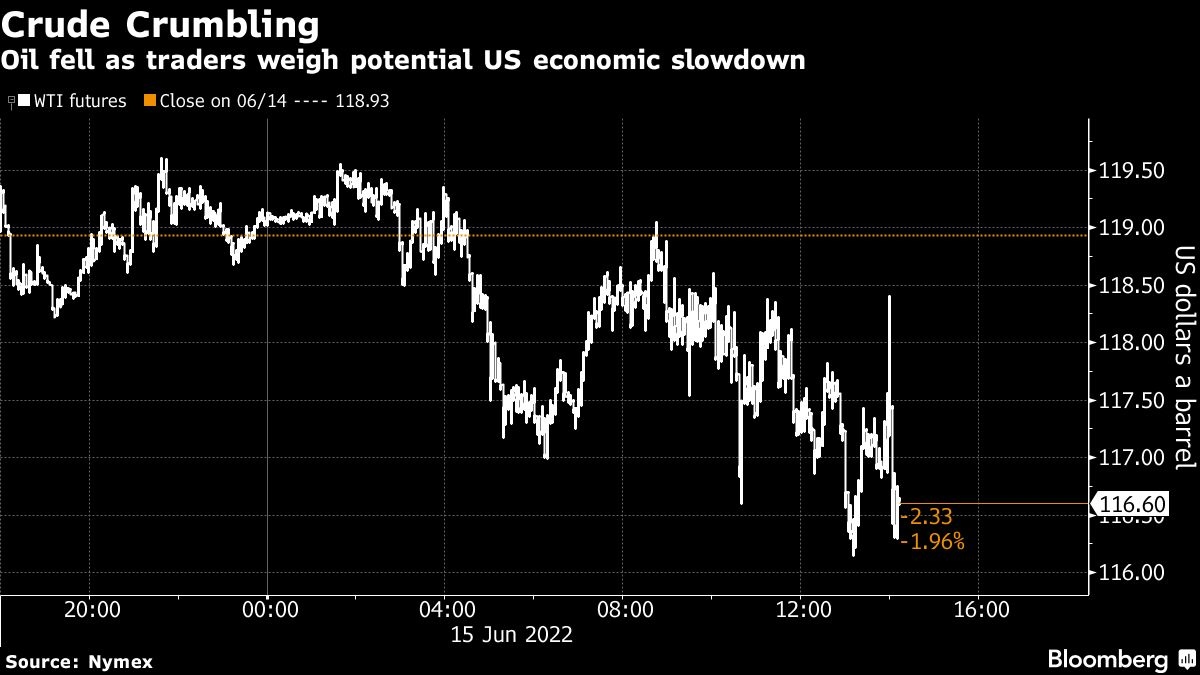

Oil falls on U.S. Fed rate hike and signals of softening demand

, Bloomberg News

Oil will drift higher as Saudi Arabia shows reluctance to increase production: Andrew Lipow

Oil fell after the Federal Reserve delivered the biggest rate increase in almost three decades and US government report showed signs of demand slipping.

West Texas Intermediate settled below US$116 for the first time in two weeks after the US central bank confirmed market expectations by raising interest rates 75 basis points. Higher interest rates could lead to an economic slowdown, and add headwinds to crude’s recent rally. Earlier in the session, prices edged lower as US crude production hit 12 million barrels a day for the first time since the start of the pandemic, while gasoline demand edged lower and is trailing seasonal norms.

US retail gasoline prices have repeatedly broken records, recently hitting US$5 a gallon, and the latest US government report shows signs that high prices are impacting consumption. This week, gasoline demand fell to the lowest seasonally since 2013, with the exclusion of 2020 when demand dropped due to Covid lockdowns.

“There is growing angst under the bull thesis and each data point is going to be heavily scrutinized for evidence of demand falling off,” said Rebecca Babin, senior energy trader at CIBC Private Wealth Management. “This leaves the market susceptible to both large moves higher and lower as investors are on a knife’s edge.”

High fuel prices are turning into an increasingly political issue as multiple efforts by the US administration to cool energy costs have so far failed to stem the inflationary tide. President Biden wrote to US oil refiners, saying that record profits are “not acceptable.”

Prices

- WTI for July delivery fell US$3.62 to settle at US$115.31 a barrel in New York.

- Brent for August settlement fell US$2.66 to settle at US$118.51 a barrel.

Russia’s invasion of Ukraine has fanned inflation after upending global trade flows and tightening crude and fuels markets. The International Energy Agency offered little hope for improvement in its monthly report, noting that oil supply will struggle to meet demand next year.

China’s economy showed a mixed recovery in May, with industrial production unexpectedly increasing while the property market continued to slump. Crude processing by the nation’s refiners marginally increased last month, capped in part by bloated fuel stockpiles, while apparent oil demand slumped.