May 11, 2022

Oil halts slide as fuel stocks plunge ahead of driving season

, Bloomberg News

Energy companies still trading at cheap valuations and are a great inflation hedge: Evan Brown

Oil rallied as the European Union continued to haggle with holdouts over a Russian crude ban while a US government report showed fuel inventories plunging ahead of the summer driving season.

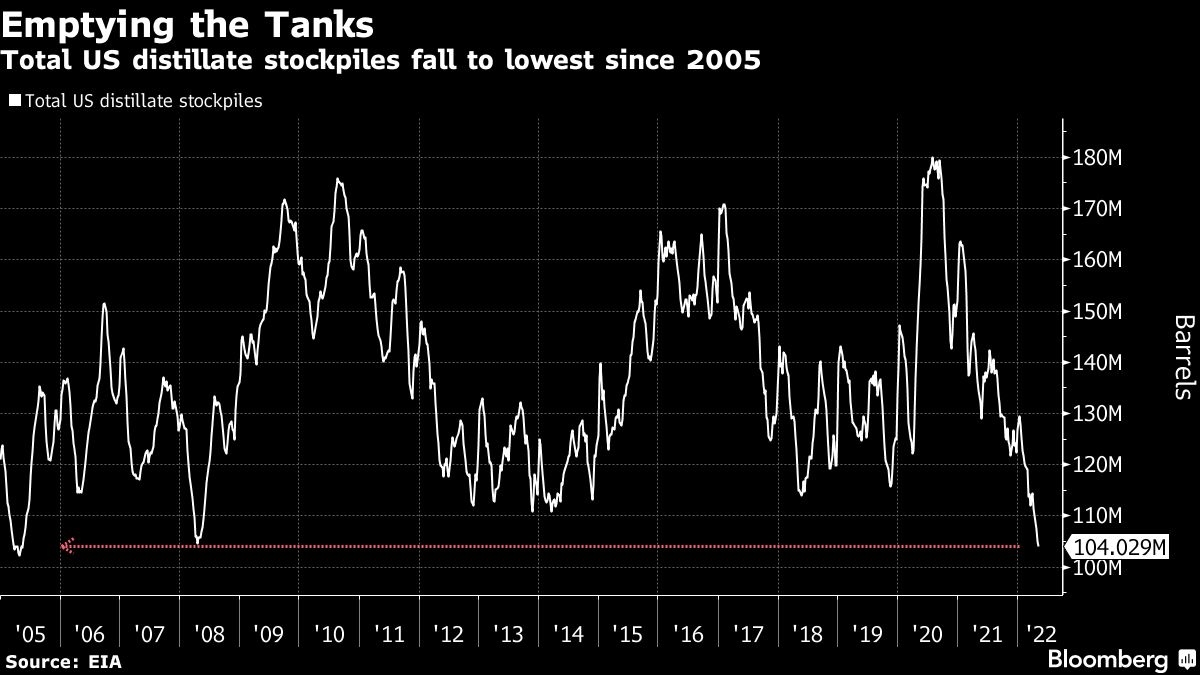

West Texas Intermediate futures rebounded over US$5 on Wednesday, halting a two-day slide in which futures shed more than US$10. On Wednesday, Hungary said it will only agree to a ban on Russian imports if shipments via pipelines are excluded. In the US, the Energy Information Administration reported that distillate inventories fell to the lowest since May 2005.

US retail gasoline and diesel prices rose to a record just ahead of the nation’s summer driving season. Demand for both products fell domestically last week but inventories are shrinking with US refiners sending more product abroad to replace Russian supplies.

Many refiners were forced to shut operations during the pandemic when fuel demand evaporated. With so much less fuelmaking capacity both in the US and across the globe it’s going to be difficult to meet refined product demand, said Quinn Kiley, a portfolio manager at Tortoise, a firm that manages roughly US$8 billion in energy-related assets.

The oil market has been whipsawed over the last couple of months by Covid-19 restrictions across China and Russia’s invasion of Ukraine. The war has fanned inflation, driving up the cost of everything from food to fuels. In the US, consumer prices rose more than expected, indicating inflation will persist at elevated levels for longer.

Oil is experiencing one of its most tumultuous trading periods ever as the war in Ukraine and the ensuing sanctions against Russia push volatility to historic levels. The oil market hasn’t been “consistent at all as of late,” said Rebecca Babin, senior energy trader at CIBC Private Wealth Management. “Trading crude right now is like trying to figure out the mood swings of a teenager.”

Prices

- WTI for June delivery rose US$5.95 to settle at US$105.71 a barrel in New York.

- Brent for July settlement gained US$5.05 to settle at US$107.51 a barrel.

Meanwhile, Shanghai reported a 51 per cent drop in new coronavirus infections on Tuesday, with zero cases found in the community -- a key metric for the city to end a punishing lockdown that’s snarled global supply chains and left tens of millions of people stuck inside their homes for about six weeks.