May 27, 2021

Oil hits highest in nore than two years as demand hope grows

, Bloomberg News

The world will not be able to get to net-zero unless oil industries step up: Suncor CEO

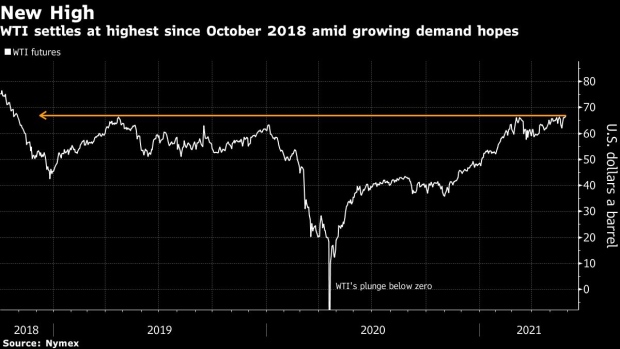

Oil closed at its highest price in more than two years as strong U.S. economic data fueled a broader market rally and Wall Street stuck to bullish views on climbing commodity prices.

West Texas Intermediate extended its winning streak to five sessions, its longest run of daily gains since February. Underscoring the recovery in the U.S., American drivers are traveling almost as many miles on interstates as they did in 2019 and jobless claims have fallen to a fresh pandemic low as businesses reopen. Goldman Sachs Group Inc. analysts said commodities continue to face incremental tightness in the second half, with little evidence to suggest enough of a supply response to derail the bull market.

That’s helping offset supply concerns this week as Iran and world powers in Vienna try to revive a nuclear accord, which could lift sanctions on the Persian Gulf nation’s oil flows. The potential supply rise comes just as the Organization of Petroleum Exporting Countries and its allies are also restarting some of their shuttered production.

“The optimism around demand is overpowering concern on Iran, so the Iranian supply risk is being put on the backburner for now,” said Bart Melek, head of commodity strategy at TD Securities. “The U.S. is the biggest consumer,” and with more of the country opening back up, “the driving season could be pretty decent.”

U.S. crude futures have been stuck in a US$10 trading range since March amid a spotty global demand recovery and concerns over supply. However, prices have been grinding higher in recent months with signs emerging that other key markets such as Europe are following the U.S. lead in the consumption rebound. Meanwhile, investment banks like Goldman and JPMorgan Chase & Co. have remained bullish on oil’s price trajectory heading into year-end.

Pullbacks in commodity prices are “a clear buying opportunity,” Goldman analysts Jeff Currie and Damien Courvalin said in a note. In oil markets, “inventories of end-use products and oil at sea continue to draw despite rising landed crude oil inventories.”

Prices

- WTI for July delivery rose 64 cents to settle at US$66.85 a barrel, the highest since October 2018

- Brent for the same month gained 59 cents to end the session at US$69.46 a barrel, the highest since May 17

OPEC+ ministers are due to meet June 1 to consider the state of the market and the group’s production policy. All but four of the 24 analysts and traders surveyed by Bloomberg News see the group affirming its plan to continue reviving output next month.

Besides potentially higher Iranian supply, the ministers will be also be assessing demand, including in the U.S. The Memorial Day weekend at the end of May usually heralds the start of the summer driving season. But gasoline stockpiles are already low and are setting the stage for a supply squeeze typically only seen when a hurricane knocks out refineries, according to one fuel distributor.

At the same time, crude flows from Iraq to the U.S. soared this month, with shipments more than doubling from April on a daily average basis to reach their highest since March 2020. Most of the crude is heading across the Pacific Ocean to the West coast, with only one Suezmax tanker heading west out of the Persian Gulf.

Other market news:

- Pipeline operators who fail to report cybersecurity attacks to the Department of Homeland Security could face fines of US$7,000 a day or more under regulations being released Thursday in response to the ransomware attack that temporarily paralyzed the nation’s biggest fuel pipeline.

- Potential removal of sanctions on Iranian oil exports “could be a tremendous kicker to the conventional, law abiding tanker market,” Lars Barstad, interim chief executive officer of Frontline Management, said on an earnings call.

- John Fredriksen, the 77-year-old billionaire who made his fortune in shipping, is stepping down as the boss of Frontline Ltd., one of the world’s largest supertanker owners.