Jan 16, 2020

Oil Holds Biggest Gain in Two Weeks on Softer U.S. Trade Tone

, Bloomberg News

(Bloomberg) -- Oil held its biggest gain in almost two weeks on optimism a less aggressive approach on trade from the U.S. will help revive growth.

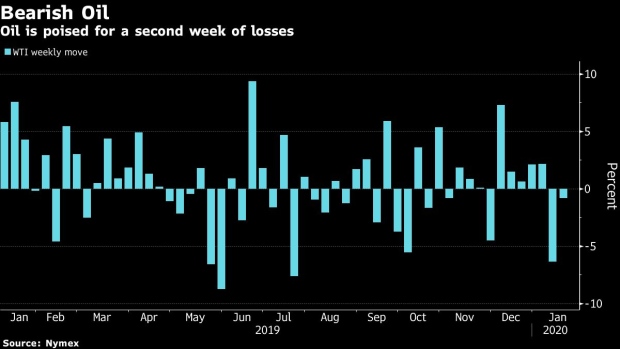

Futures in New York were steady after closing up 1.2% Thursday. Washington and Beijing signed a phase-one trade deal on Wednesday, while the Senate passed the U.S.-Mexico-Canada free trade agreement a day later. However, that wasn’t enough to stop crude from heading for a second weekly decline after a big jump in American oil-product stockpiles highlighted weak demand.

China pledged $52.4 billion in additional purchases of American energy over 2020 and 2021 in the agreement, although there was some skepticism in the market about whether it would be able to reach the target. Meanwhile, the International Energy Agency warned in its monthly report that supplies from Iraq, the Middle East’s second-biggest producer, are potentially vulnerable due to rising political risks in the country and broader region.

“The big mover for oil was the double whammy of positivity from the U.S.-China trade deal and the Senate passing the USMCA,” Stephen Innes, Asia Pacific market strategist at AxiTrader, said in a note. That “should provide a significant lift to the U.S. economy and give a boost to oil prices since the U.S. is the largest consumer of oil,” he said.

West Texas Intermediate crude for February delivery added 1 cent to $58.53 a barrel on the New York Mercantile Exchange as of 9:44 a.m. in Singapore. It’s down 0.9% this week, set for the first back-to-back weekly drop since October.

Brent for March settlement fell 7 cents to $64.55 on the ICE Futures Europe exchange after climbing 1% on Thursday. The contract has fallen 0.7% for the week. The global benchmark crude traded at a $6.05 premium to WTI for the same month.

--With assistance from James Thornhill.

To contact the reporter on this story: Elizabeth Low in Singapore at elow39@bloomberg.net

To contact the editors responsible for this story: Serene Cheong at scheong20@bloomberg.net, Andrew Janes, Ben Sharples

©2020 Bloomberg L.P.