May 31, 2023

Oil extends slump as Chinese data threatens demand outlook

, Bloomberg News

Oil has lost steam: Portfolio manager

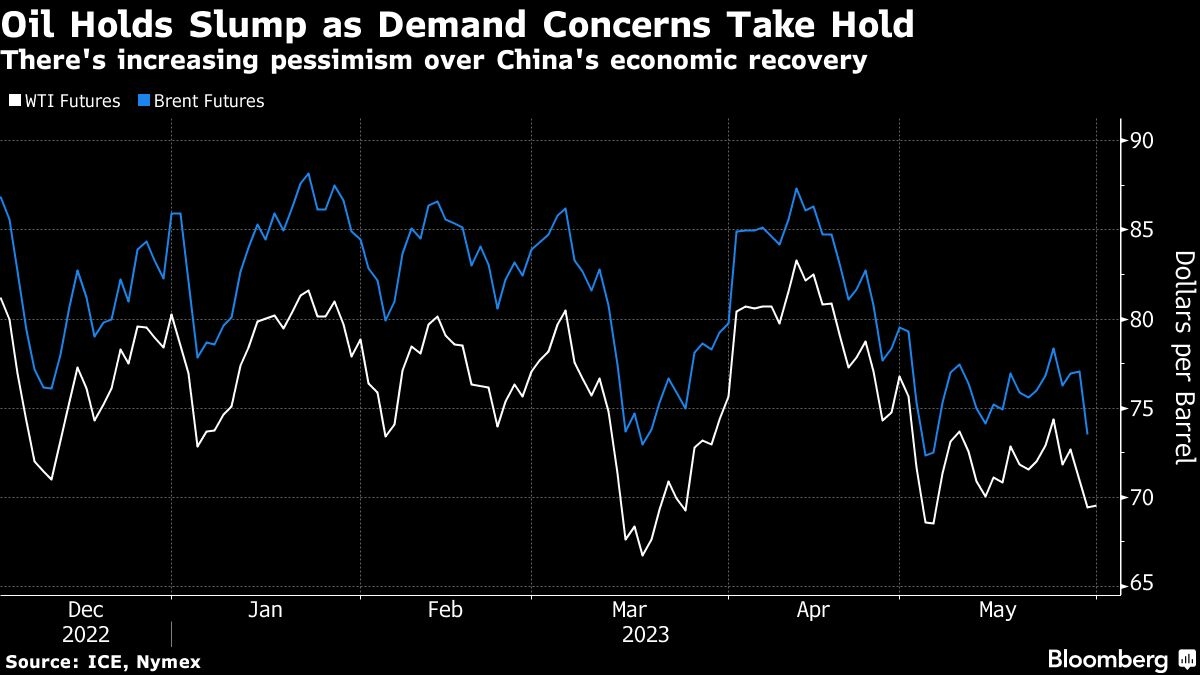

Oil edged lower, extending its biggest decline in four weeks as weaker-than-expected economic data from China added to concerns of weaker demand.

West Texas Intermediate fell below US$69 a barrel Wednesday after settling 4.4 per cent lower Tuesday. China’s manufacturing activity contracted at a worse pace than in April, raising a fresh signal the post-COVID rebound has lost momentum in the world’s biggest crude importer. The U.S. dollar also rose, making commodities priced in the currency more expensive for international investors.

“The bearish market mood persists, feeding itself on different things, especially China’s loss of economic momentum,” said Norbert Ruecker, head of economics and next generation research at Bank Julius Baer. “Western world oil demand stagnates, Russian flows establish themselves outside of the West’s hemisphere and petro-nations’ supplies are likely to continue to surpass pledged quotas.”

Oil is down about 15 per cent this year as concern about China’s economic recovery and tighter monetary policy from the Federal Reserve weighed on the demand outlook. Wrangling over the U.S. debt ceiling has added to bearish sentiment, although progress has been made in recent days.

The debt-limit deal struck by President Joe Biden and Speaker Kevin McCarthy is heading toward a vote Wednesday in the House of Representatives after clearing a crucial procedural hurdle with just days remaining to avoid a U.S. default. Legislation to temporarily suspend the U.S. borrowing ceiling and cap federal spending was advanced by the House Rules committee Tuesday night.

OPEC+ is meanwhile scheduled to meet over the weekend in Vienna to discuss the group’s output policy, and most market watchers surveyed by Bloomberg expect the coalition to keep production unchanged. Fundamentals don’t support a case for curbs, although a weak macroeconomic environment does, according to Standard Chartered Plc. RBC Capital Markets LLC said a “lean cut” might be agreed.

Prices:

- WTI for July delivery fell 1.6 per cent to US$68.31 a barrel at 10:56 a.m. in London.

- Brent for July settlement, which expires Wednesday, slipped 1.7 per cent to US$72.27 a barrel.

- The August contract was 1.6 per cent lower.