Mar 22, 2023

Oil Holds Onto Gains as Federal Reserve Raises Rates

, Bloomberg News

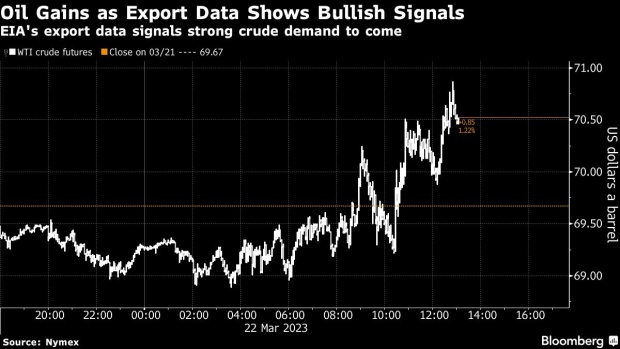

(Bloomberg) -- Oil rose to settle above $70 a barrel for the first time in a week, bolstered by bullish export data and a lack of surprises from the Federal Reserve.

Exports of crude and refined products surged to a record 12 million barrels a day, the Energy Information Administration said Wednesday, suggesting a rosier demand outlook. Meanwhile, the Fed delivered its second straight 25 basis-point rate hike, matching expectations.

“The knee-jerk reaction in risk assets is to the upside as the market anticipates the end of the tightening cycle is near and cuts could be forthcoming,” said Daniel Ghali, a commodity strategist at TD Securities.

Banking turmoil drove crude to a 15-month low last week as traders’ appetite for risk waned. Famed oil trader Pierre Andurand is among investors who have been caught out by the declines, with losses in March helping drive his hedge fund down 40%. Still, Andurand and others remain bullish on the outlook for crude, in part due to China’s rebound from Covid lockdowns, with some forecasting prices of $140 a barrel by the end of the year.

A shift in positioning also followed last week’s collapse as money managers’ bullish bets on WTI fell to the lowest level since the coronavirus pandemic, according to the latest Commodity Futures Trading Commission data. That shift allows “limited friction to upside in crude as positioning was scorched last week,” said Rebecca Babin, senior energy trader at CIBC Private Wealth.

Energy Daily, Bloomberg’s daily energy and commodities newsletter, is now available. Sign up here.

--With assistance from Julia Fanzeres and Natalia Kniazhevich.

©2023 Bloomberg L.P.