Sep 4, 2018

Oil near US$70 as dollar strengthens

, Bloomberg News

The crude market is placing more importance on a stronger dollar and a potential Cushing, Oklahoma, stockpile build than on Tropical Storm Gordon’s threats to oil assets.

Futures advanced as much as 2.3 per cent on Tuesday before fluctuating between gains and losses. Strength in the dollar helped cap a morning crude rally and expectations of a 600,000-barrel increase in supplies at the key Cushing storage hub last week also weighed on the benchmark. Traders are still keeping an eye on Tropical Storm Gordon as it approaches the U.S. Gulf Coast.

“The dollar is leaning on the market,” said Bob Yawger, director of the futures division at Mizuho Securities USA LLC. Meanwhile, Gordon “doesn’t look like it’s going to tear up the oil patch in the Gulf.”

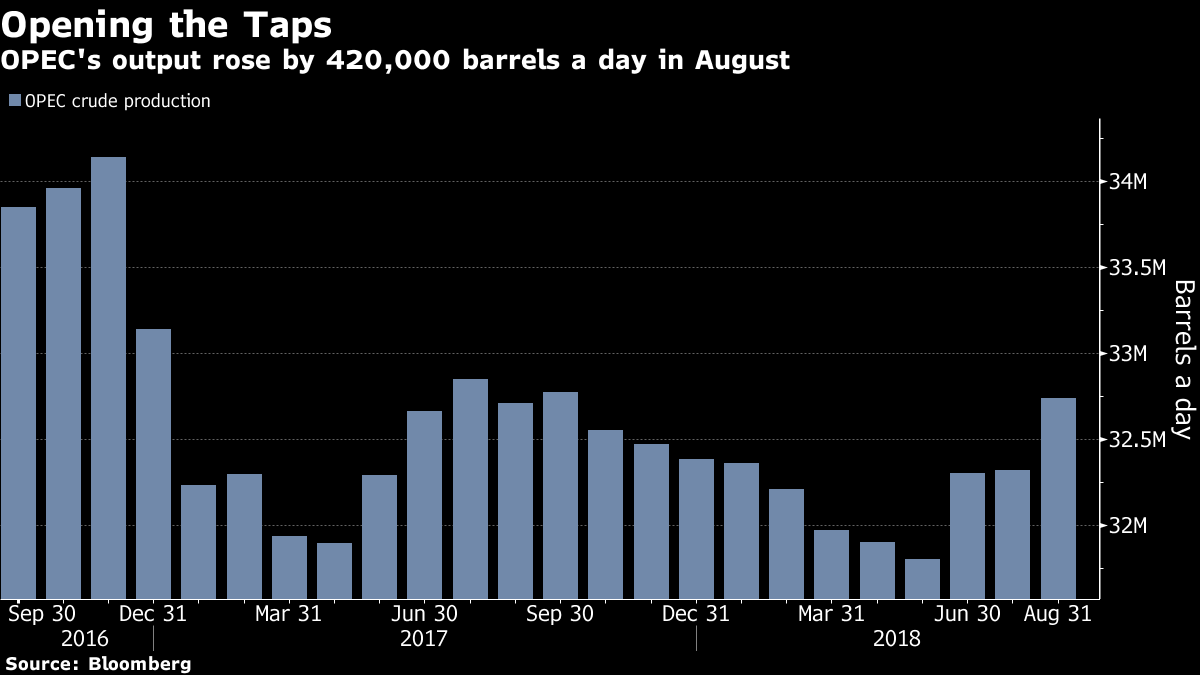

Oil posted a 1.5 per cent gain in August in New York and the global benchmark Brent also rose as investors focus on the impact Iranian sanctions are having on global crude markets. Yet, Iran will keep selling oil in spite of an expected resumption of sanctions on the country’s crude shipments, President Hassan Rouhani said. Traders are also watching for whether OPEC will fill any supply gaps after crude production from the group rose in August to the highest level this year.

West Texas Intermediate for October delivery added 29 cents to US$70.09 a barrel at 12:10 p.m. on the New York Mercantile Exchange. Monday trades will be booked Tuesday because of the U.S. holiday. Average volume traded Tuesday was about 33 per cent above the 100-day average.

The Bloomberg Dollar Spot Index rose as much as 0.7 per cent on Tuesday, diminishing the appeal of dollar-denominated commodities.

Brent for November settlement climbed 19 cents to US$78.34 a barrel on the ICE Futures Europe exchange. The global benchmark crude traded at a US$8.59 premium to WTI for the same month.

Anadarko Petroleum Corp. stopped production and removed all personnel from two Gulf of Mexico platforms and Chevron Corp. also shut in production at a Gulf of Mexico facility as Tropical Storm Gordon is forecast to strike the coast as a hurricane on Tuesday.

Gordon, with top winds of 65 miles (105 kilometers) per hour, was about 190 miles east-southeast of the mouth of Mississippi River, according to a National Hurricane Center advisory at 8 a.m. New York time. On Monday, New Orleans Mayor LaToya Cantrell declared a state of emergency for the city to prepare for Gordon, according to an emailed statement from her office.

So far, operations at U.S. refineries in the storm’s path have not been affected.

Other oil-market news:

Gasoline futures added 0.5 per cent to US$2.0074 a gallon. Transocean Ltd. agreed to buy Ocean Rig UDW Inc. for about US$2.9 billion to expand its ultra-deepwater drilling fleet. As oil markets show growing global supply concern, Iraq is signaling the jitters may be overdone. Output from OPEC’s second-biggest producer has jumped to a record and is set to expand further, reflecting higher investment in the country’s southern fields following crude’s rally. BP Plc plans to roll out technology that predicts when equipment needs to be repaired to more than 30 offshore platforms globally after a successful trial in the Gulf of Mexico.